First Single-Family REIT Refinance Highlights Asset Appreciation

Friday, July 15, 2016 by Zelman & Associates

Filed under: institutional investorssingle-family rental

Progress Residential is a single-family REIT that owned approximately 17,000 homes as of 1Q16, making it the fourth largest in the country behind Invitation Homes (~48,000), American Homes 4 Rent (~48,000) and Colony Starwood Homes (~32,000). The REIT issued its first securitization in September 2014 for roughly $475 million with the highest concentration of homes in Arizona (23%), Florida (22%), Georgia (16%) and Texas (13%).

With the securitization approaching its initial two-year borrowing period, the company has decided to repay the debt with proceeds from a larger securitization, the first such instance where a REIT did not exercise its annual extension. The new securitization is expected to total over $650 million to as much as $875 million and interestingly, approximately 88% of the homes included as collateral in the initial securitization are being rolled over into the new borrowing.

Comparing the broker’s price opinion from September 2014 to June 2016 for these homes reveals a 10.6% increase in value, which annualizes to 5.9% per year, nearly identical to the change in Zelman’s national existing home price index and underscoring the improvement in net asset value for single-family REITs.

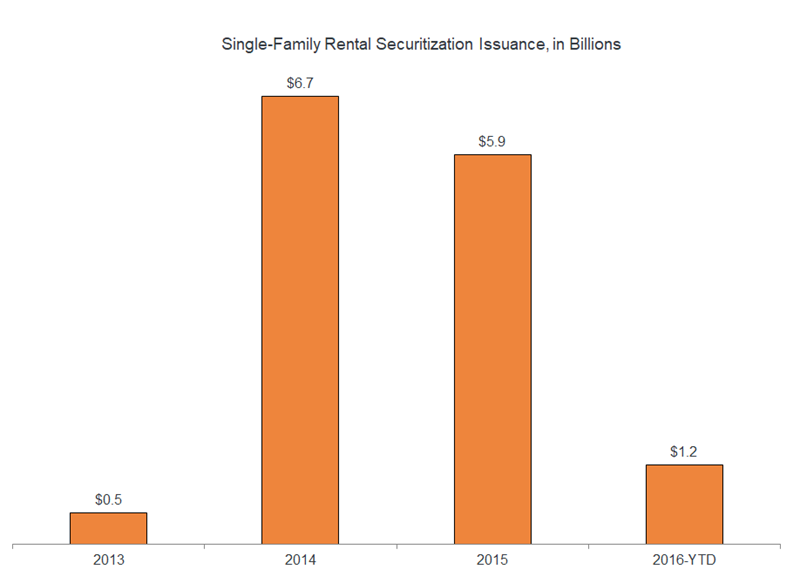

Progress Residential’s pending securitization will mark the 25th deal for the single-family sector since inception in the public markets, aggregating to over $14 billion. While issuance has been slower out of the gate in 2016 due to volatility in the financial markets, underlying fundamentals have been strong.

Friday, July 15, 2016 by Zelman & Associates

Filed under: institutional investorssingle-family rental

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey