How Do We Reconcile Good Single-Family Housing With Bad Homeownership?

Friday, July 29, 2016 by Zelman & Associates

Filed under: homeownership

For 2Q16, the Census Bureau announced that the national homeownership rate registered 62.9%, down 50 basis points from 2Q15. The headline was particularly eye-catching given that it tied 2Q65 for the lowest second quarter level of the last 52 years. While many view the homeownership rate to be the main measure of health for the housing market, we believe important nuances are overlooked and the conclusions are often misinterpreted.

First, the calculation of the homeownership rate continues to be impacted by the lagging function of foreclosures that speak more to the prior crisis than current decisions. For example, according to CoreLogic, approximately 460,000 foreclosures were completed over the last year. While not all of these homes were owner-occupied, we believe that the vast majority would be. As such, they would have been considered “owners” in 2Q15 and likely “renters” in 2Q16. If we exclude this subset from the national calculation, the 2Q16 ownership rate would have been 63.2%, essentially flat with an adjusted 63.3% in 2Q15. As the distressed pipeline continues to shrink, this headwind should fade.

Second, we believe that the homeownership rate is wrongly associated with single-family housing demand. While it is true that 88% of owned homes are of the single-family variety, it is also true that single-family homes are a sizeable share of the rental stock at roughly 35% and that they have gained significant share over the last decade alongside the foreclosure crisis.

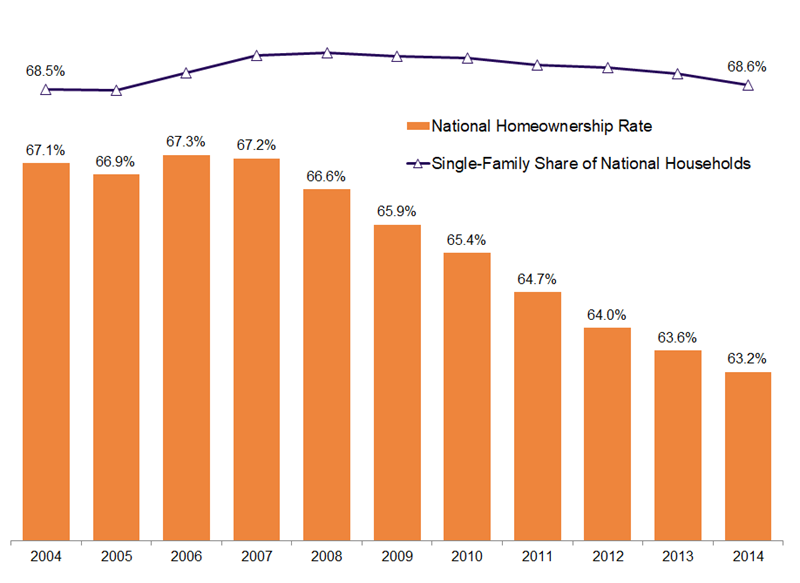

Using data from the latest American Community Survey (ACS) to more completely analyze the homeownership rate and the type of housing in demand, consider that from 2004-14, the homeownership rate according to the ACS fell 390 basis points to 63.2% from 67.1%. Meanwhile, the single-family share of households, regardless of whether they were owned or rented, actually increased 10 basis points to 68.6%.

In our opinion, the homeownership rate is cyclical and is presently reflecting lingering effects from the recession, mainly lagging foreclosures, below-average savings among young adults that were under-employed several years ago and delayed family formations, but we suspect the rate is near a trough. Importantly, even if it is not near a trough, we would remain positive on single-family new construction demand because how a home is financed is irrelevant to the amount and type of homes the country needs.

Friday, July 29, 2016 by Zelman & Associates

Filed under: homeownership

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey