Non-Bank Mortgage Originators Most Accommodating to FHA Borrowers

Friday, July 29, 2016 by Zelman & Associates

Filed under: entry-levelmortgage

In recent years, national banks have faced numerous legal headwinds related to legacy mortgage exposure, incurring billions of dollars of fines in aggregate, which has led many to de-risk their origination business. This has been particularly true of late for FHA loans given the Department of Justice suing and securing large settlements under the False Claims Act.

For example, thus far in 2016, 21% and 3% of mortgages in agency securitizations (Fannie Mae, Freddie Mae and Ginnie Mae) originated by Wells Fargo and Citibank were backed by the FHA, down substantially from 26% and 9% in 2015, respectively. The decline has largely been driven by uncertainty related to future litigation, even under the assumption that all guidelines are being presently followed appropriately.

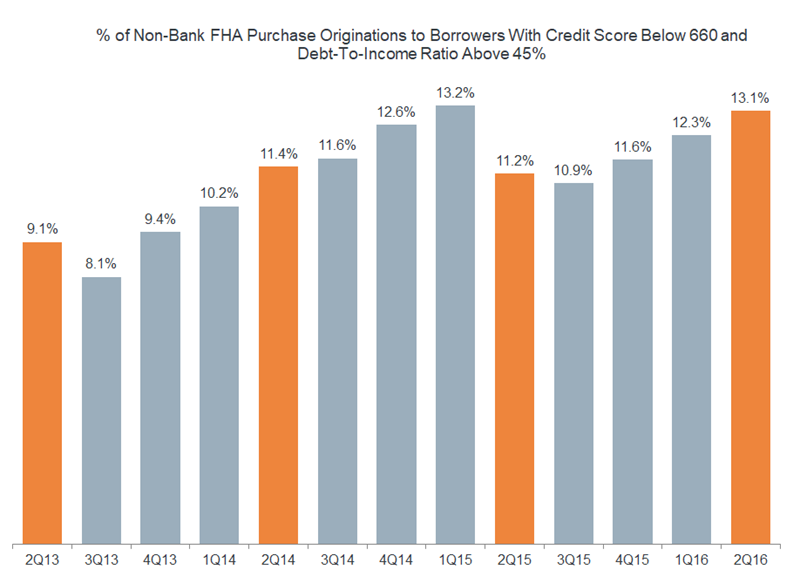

However, while the retrenchment of such large entities could be considered a risk to the broader housing market and entry-level buyers, non-banks have welcomed the share and remain comfortable operating within the scope of FHA guidelines, and increasingly on the lower end of credit metrics. For example, non-banks accounted for 65% of FHA purchase mortgage production in 2Q16, up from 56% in 2Q15 and 47% in 2Q14. Furthermore, 13% of FHA purchase originations by non-banks in 2Q16 were to borrowers with credit scores below 660 and debt-to-income ratios above 45%, with the share rising from 9% three years ago.

While this shift could be interpreted as originators taking unnecessary risk to drive volume, we conversely believe that borrower credit quality is extraordinarily high relative to history and in turn view the expansion of the credit box as a sign of recessionary overhangs being slowly alleviated, which should continue to contribute to a positive backdrop for potential entry-level homebuyers.

Friday, July 29, 2016 by Zelman & Associates

Filed under: entry-levelmortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey