In its most recent weekly survey of mortgage rates, Freddie Mac reported that the national average for a 30-year fixed-rate product was approximately 3.40%, only 10 basis points higher than the historical low posted in late 2012 dating back to 1971 when the survey began. Including the upfront cost of refinancing, we estimate that at current mortgage rates, approximately 35-40% of borrowers are “in-the-money”, or would benefit from refinancing into a lower interest rate.

However, we estimate that only 7% of mortgage holders will refinance their mortgage in 2016, leaving the obvious question of why a greater share of borrowers does not take advantage of these historically low rates. To help answer this question, we rely on feedback from our proprietary survey of 3,000 consumers that included detail about their mortgage status and refinancing trends.

For perspective, from 2012 when mortgage rates first dropped below 4.0% through 2015, 35% of survey participants refinanced their mortgage. Meanwhile, 23% last refinanced before 2012 and 38% have never refinanced their mortgage. Somewhat surprisingly, of the 38% of mortgage holders that have never refinanced, 64% moved into their home and presumably first put the mortgage in place prior to 2013.

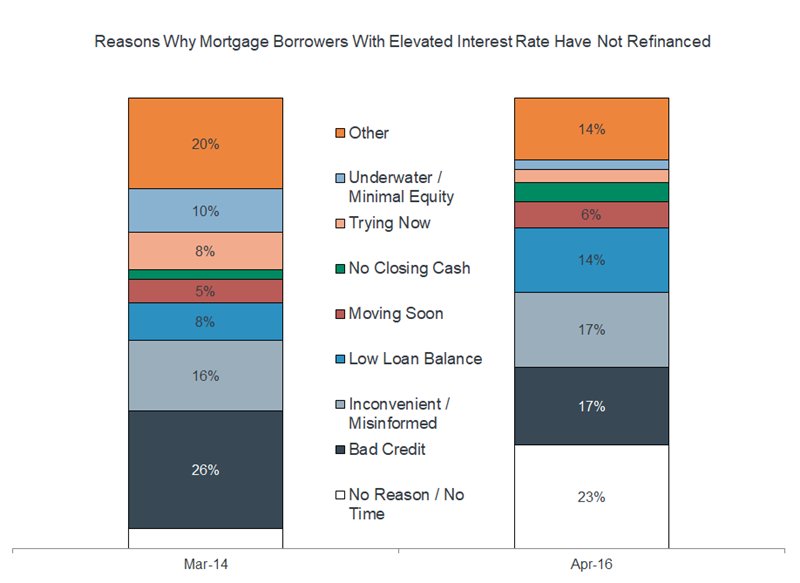

We subsequently asked borrowers with a mortgage rate of 5.0% or higher, why they have chosen not to refinance their mortgage. Roughly 23% of respondents could be classified generally as not having a reason (“I don’t know”) or lacking the time (“Just haven’t got around to it”), followed by 17% that cited bad credit and another 17% that were either misinformed (“Refinancing is expensive”) or too skeptical of the process (“Too much trouble”). Other factors that came into play were having a low loan balance and not being able to spread the upfront costs over enough years (14%), planning on moving soon (6%) or not having enough savings to fund the closing costs (4%). The lack of a clear rationale for not refinancing for many consumers is consistent with our similar survey conducted in 2014 and appears to be a structural part of the market. However, positively, those that cited bad credit (17% versus 26%) or being underwater relative to the value of their home (2% versus 10%) was down notably over this period.

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey