Analyzing Impact of Student Debt on Homeownership and Single-Family Living

Friday, August 26, 2016 by Zelman & Associates

Filed under: demographicsstudent debt

Earlier this month, Fannie Mae posted an article titled “Student Debt Isn’t the Roadblock to Homeownership Many Believe”, emphasizing that student debt is not the deciding factor behind whether young adults own their home or not, because it overlooks the associated income that typically comes alongside student debt and higher education. Similar to our prior conclusions, the article points out that the “problem” of student debt is when it is absorbed without graduating. The other aspect that is often ignored from the student debt-homeownership debate is whether it impacts the type of housing required for young adults, which ultimately drives new construction demand.

To further this discussion, we utilize the results of our nationally-representative survey of 3,000 adults conducted earlier this year. Given that age and demographic circumstances can influence behavior, for this analysis, we focus on 25-29 and 30-34 year olds, split by whether they are in a “couple” living environment, which we define as either married or living with a romantic partner, or not.

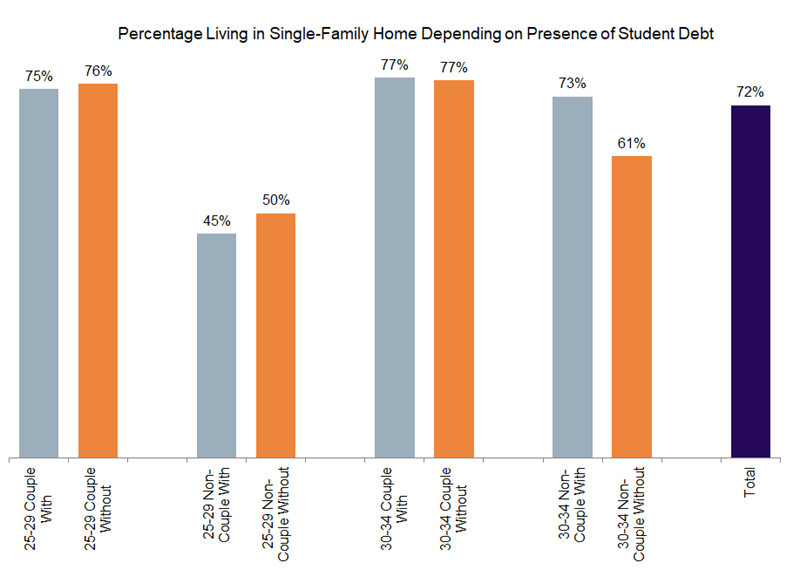

For these four distinct groups: (1) 25-29 year olds living as couples; (2) 25-29 year olds living as non-couples; (3) 30-34 year olds living as couples; and (4) 30-34 year olds living as non-couples, the homeownership rate is actually slightly higher for those with student debt in three of the four groups, with 25-29 year olds living as couples the exception.

Perhaps even more importantly when considering how student debt impacts the type of housing required, in every case except 30-34 year old couples with student debt, a higher share of respondents lived in a single-family home than owned their home and minimal variation was evident when comparing those with and without student debt.

While we do not ignore that a rising amount of student debt impacts housing demand relative to history, we do not believe that the negative overhang often portrayed in the media is appropriate. In fact, our research shows that family formation, particularly the presence of children, most directly drives young adults to single-family living and whether they own or rent that unit is subsequently determined by their income. Assuming that the presence of student debt is part of the means to achieve the required income, we believe it is positive for the long-run equilibrium homeownership rate.

Friday, August 26, 2016 by Zelman & Associates

Filed under: demographicsstudent debt

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey