Based on Credit Scores, How Tight Is Mortgage Underwriting Versus History?

Friday, August 12, 2016 by Zelman & Associates

Filed under: entry-levelmortgage

In the mainstream media, it is common to find opinions that mortgage credit availability is “too tight” or “a headwind for first-time homebuyers” or “only available to pristine borrowers.” While we do not believe that to be true as terms on FHA mortgages, in particular, are lenient enough with respect to credit score and downpayment requirements, which are both consistent with historical norms, we do believe that a significant share of consumers are unware of the availability and originators remain more conservative than in the past.

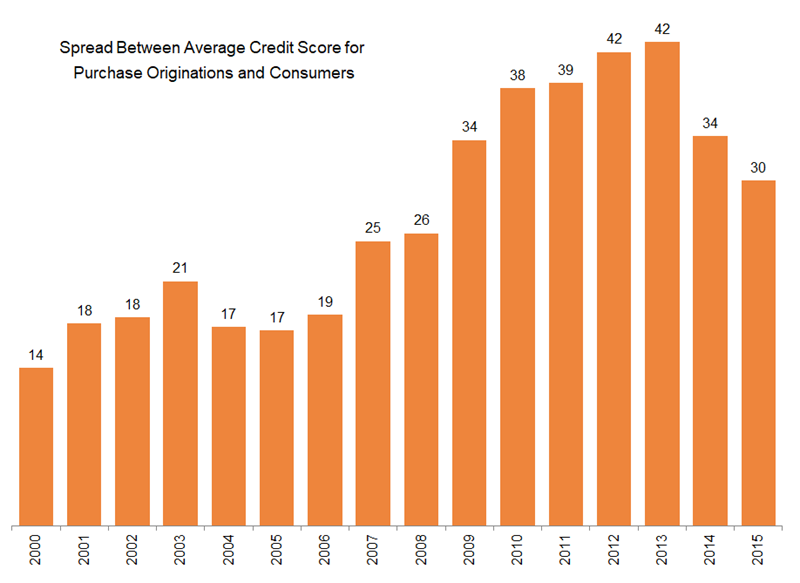

To help quantify the present situation, we comparaed the average credit score for purchase mortgages securitized by Fannie Mae, Freddie Mac and Ginnie Mae to the average credit score of all consumers as estimated by the New York Federal Reserve.

For example, in 2015, the average credit score for purchase mortgage originations was 724, or 30 points higher than the average for all consumers. That spread was widest in 2013 at 42 points, signaling a mismatch between credit quality of potential borrowers and originations for actual borrowers.

In contrast, from 2000-03, the average credit score underpinning agency securitizations ranged from 695-704, or roughly 15-20 points higher than the average credit score for all consumers at that time. In our opinion, this period represents more normal credit behavior as it was before excessively loose standards that began to evolve in 2004 and excludes the entire non-agency market that was dominated by subprime loans.

In other words, average credit scores for purchase mortgages could retreat another 10-15 points before reaching a more normal balance with overall consumer credit quality, which we suspect would be almost entirely driven by the share of lower credit score borrowers rising to a more traditional level. To the extent this unfolds as expected, entry-level and younger borrowers should disproportionately benefit.

Friday, August 12, 2016 by Zelman & Associates

Filed under: entry-levelmortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey