After Strong Home Price Increases This Cycle, Affordability Still Screens Favorably

Friday, September 9, 2016 by Zelman & Associates

Filed under: affordabilityhome pricing

There are numerous home price measures that are provided by the government and private entities, both for free and a charge, that offer market participants a general understanding of national pricing. Given that all of the datasets have their strengths and limitations, rather than rely solely on one index, we aggregate an existing home price index that incorporates five different sources.

As of June, our index was up 5.5% year over year, which compares to year-end appreciation of 6.2% in 2015 and 4.7% in 2014. Since the first annual increase of the recovery in 2012 at 7.5% and robust strength in 2013 at 9.7% when the rebound began to gain steam, price appreciation has moderated to a very healthy, but more stable pace.

For perspective, through the peaks and valleys of the last 20 years, our home price index has averaged an approximate 4% increase, surpassing overall consumer price inflation of roughly 2% and entry-level income growth of 3%. The differential between home price appreciation and income growth has been bridged by the consistent decline in interest rates.

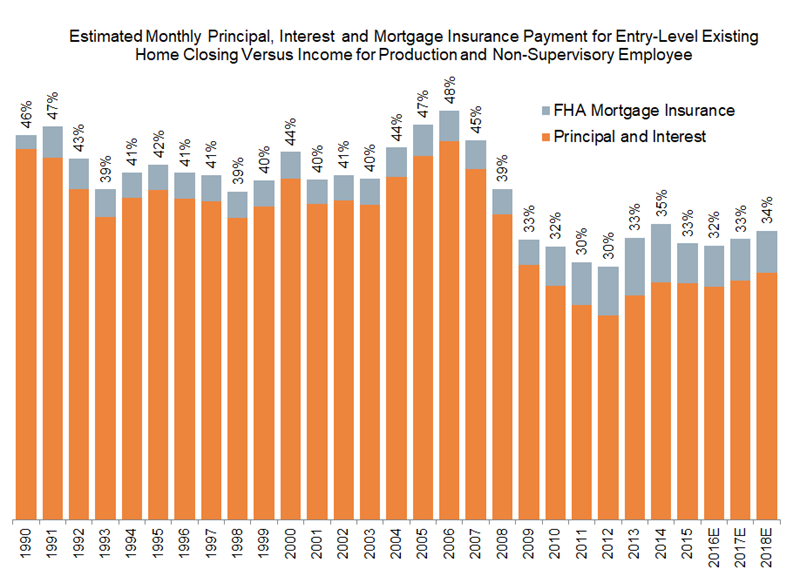

For example, in 1996 when the average 30-year fixed mortgage rate approximated 7.75%, the carry cost of the national median existing home, inclusive of principal, interest and FHA mortgage insurance was roughly $735 per month, equal to 41% of income for one individual working as a non-supervisory or production employee.

In 2016, the mortgage rate is likely to average 3.55%, leaving the $1,020 median monthly payment at just 32% of the comparable income. In fact, the 32% estimated ratio in 2016 stands substantially below the 42% average from 1990-2009 and also does not reflect the benefit of dual-income households increasing over time.

In short, while national home price appreciation has been strong since 2011, aggregating to over 35%, it was after significant declines, and absolute measures still screen favorably relative to income. If the decline in global interest rates reverses and mortgage rates return to 5%, 6% or 7% over the next several years, then we believe home price appreciation would bear the brunt of the payment shock beyond income growth, just as it has benefited over the last several decades. In our view, that remains an unpredictable scenario and the reality of today’s market is that consumers are benefiting from reduced borrowing costs just like governments and corporations around the globe.

Friday, September 9, 2016 by Zelman & Associates

Filed under: affordabilityhome pricing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey