Consumer Misperception of Mortgage Credit Leaves Opportunity

Friday, September 23, 2016 by Zelman & Associates

Filed under: mortgage

For industry executives primarily dependent on the housing market for revenue, it is widely understood that consumers can secure a mortgage with less than 20% down – the benchmark that was more common in prior generations but has now shifted to the minority of purchases. In fact, led by a 3.5% minimum downpayment requirement through the Federal Housing Administration (FHA) and 100% financing available via the Department of Veterans Affairs (VA), 67% of securitized purchase mortgages originated thus far in 2016 have less than a 20% downpayment. However, we do not believe that the consumer fully appreciates current mortgage underwriting criteria, including for the downpayment.

Earlier this year, we surveyed 3,000 consumers in a detailed manner, with questions spanning current demographic, housing and financial circumstances. For consumers that either rented their home or lived with their parents, we first asked if they believed they could qualify for a mortgage. This year, 37% responded yes, improved from 30% when we conducted the same survey two years ago.

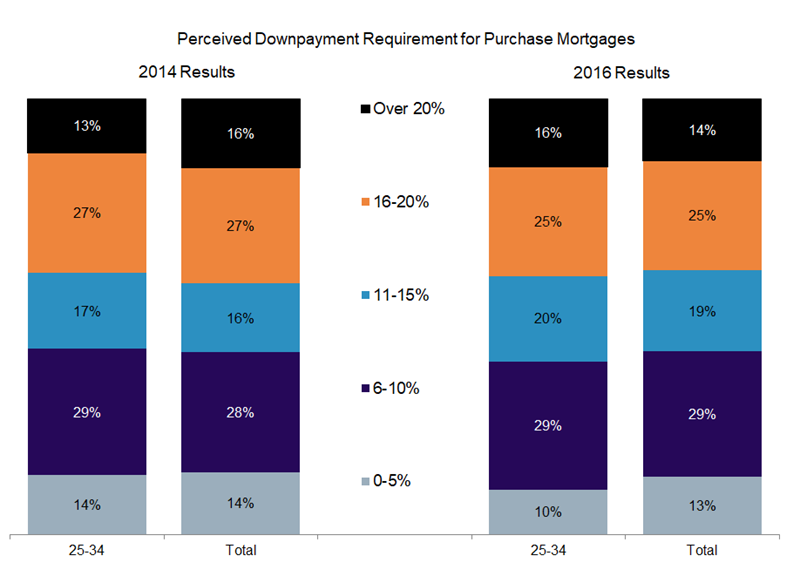

For the 63% of respondents that did not believe they could qualify for a mortgage, we separately asked “how much of a downpayment do you believe is required by a lender to purchase a home?”, providing six options ranging from 0-5% to 26% or more. Across all age cohorts, only 13% selected 0-5%, despite the aforementioned low downpayment options available in the marketplace. Further telling, 39% of respondents believed more than 15% was required. The share of responses skewed to higher downpayments across age cohorts and income profiles.

When comparing the results of our 2014 and 2016 surveys, overall perception of mortgage credit availability has improved, but of those that do not believe they could qualify, there continues to be a disconnect between actual mortgage credit availability and the perception of mortgage credit availability. Positively of late, new lender and government-driven partnerships such as “yourFirst Mortgage” introduced by Wells Fargo in tandem with Fannie Mae, which allows downpayments as low as 3%, have put a brighter spotlight on credit availability and helped to gradually close the disconnect between reality and perception. We expect this tailwind to gain momentum over the next several years given strong credit quality and near record-low delinquency trends for recent applicants.

Friday, September 23, 2016 by Zelman & Associates

Filed under: mortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey