Facts Behind “Millennials” and Home Purchases

Friday, September 9, 2016 by Zelman & Associates

Filed under: demographicsentry-levelmillennials

It seems that not a day goes by that a major news outlet does not mention the term “Millennial,” typically with a focus on how this generation is likely to impact the economy as it ages. The term Millennial was initially used to describe young adults that would become 18 around the turn of the Millennium, but unlike the “Baby Boomers” that are generally accepted as being born over the 19 years covering 1946-64, we find the Millennial generation is often defined differently. For our purposes, we define the group as those born over the 19 years covering 1984-2002, which allows for the group to be comparable to the Baby Boomers and the generation in between born from 1965-83.

The importance of the Millennials rests with them being 12% larger than the 1965-83 generation and the fact that many of these individuals were entering the workforce at the heart of the financial crisis and the terrible economic environment that it overlapped. Due to the drag on income and savings and delayed family formations, housing demand was perhaps more negatively impacted by the recession than any other area of consumer spending. However, according to our research, with these effects fading, the entry-level price point is presently the strongest segment of the market and this cohort has outpaced overall home purchases in each of the last three years.

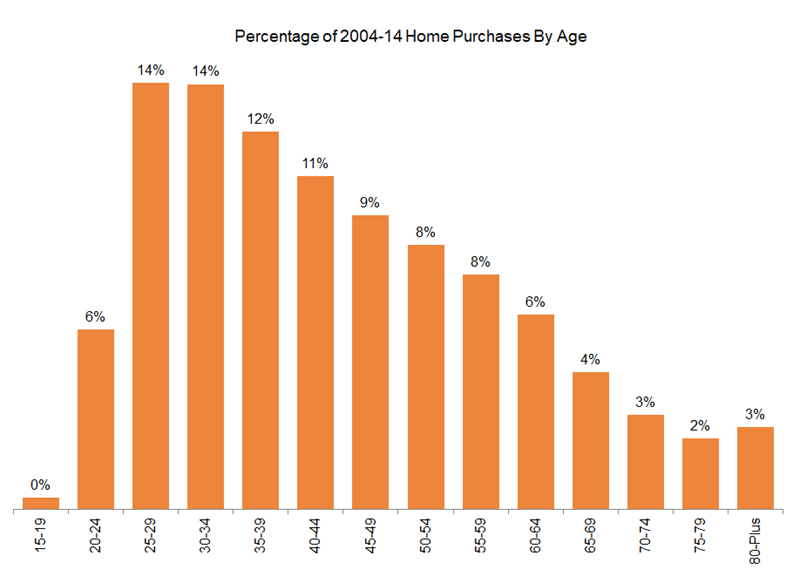

To help frame the importance of these young buyers to housing, we analyzed American Community Survey data from the Census Bureau to calculate the share of total home purchases by age. From 2004-14, 25-39 year olds accounted for 39% of owner-occupied home purchases despite only representing 26% of the adult population. The age cohorts that have been most disproportionately exposed to a home purchase relative to their population size, in order, are 30-34 year olds, 35-39 year olds and 25-29 year olds.

With the Millennials, per our definition, currently being 14-32 year olds and many aging into prime homebuying cohorts over the next 5-10 years, we believe that the demographic story for entry-level and first-time price point housing remains encouraging. In addition to the typical demographic behavior, we also expect pent-up demand from consumers that delayed a potential purchase during and after the recession, particularly as family formations are accelerating.

Friday, September 9, 2016 by Zelman & Associates

Filed under: demographicsentry-levelmillennials

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey