The Fed Watch: What Does Next Raise Mean for Mortgage Rates?

Friday, September 9, 2016 by Zelman & Associates

Filed under: mortgage rates

The Federal Open Market Committee (FOMC) is scheduled to announce its next policy rate decision on September 21st, putting the trajectory of interest rates back into the media headlines. Last December, the FOMC raised the target for the federal funds rate by 25 basis points to 0.25-0.50%. At the time, it was assumed to be the first of many increases as lenient monetary policy was slowly tightened. However, the market is still awaiting the first increase of the year, despite the expectation among economists at the beginning of the year for 3-4 additional 25 basis point increases in 2016.

With the next increase anticipated before year end, likely in December, we revisit the discussion of what this might mean for mortgage rates. Importantly, we find that many market participants directly link the FOMC decisions to mortgage rates even though they are driven by long-term interest rates, which the FOMC does not control, rather than the short-term rates within their control.

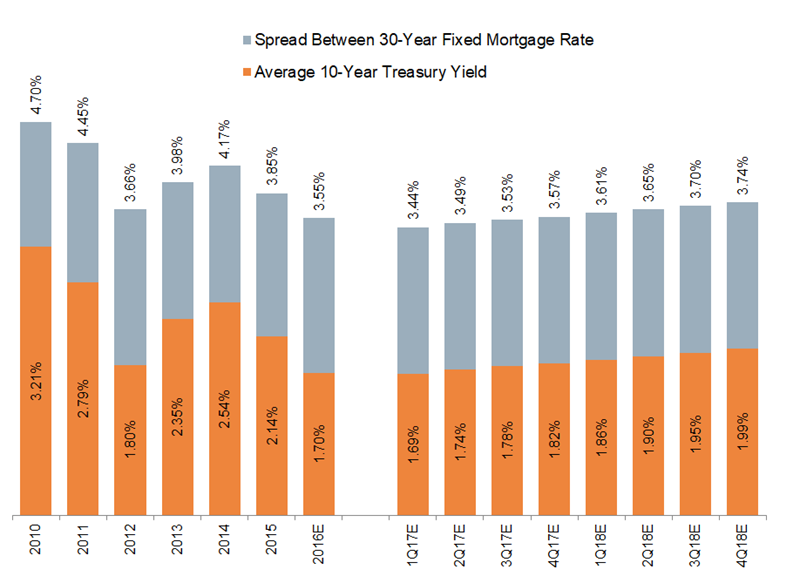

More specifically, given the longer duration of a typical 30-year fixed mortgage, there has historically been a strong correlation with the 10-year Treasury yield. Over the last five years, the average 30-year fixed mortgage rate of roughly 3.90% has stood 175 basis points above the 10-year Treasury, with that spread holding in a fairly tight range of 155-200 basis points. In essence, it is not the federal funds rate that those concerned with the direction of mortgage rates should be focused on. Instead, the question should be what could affect the long end of the yield curve?

Unlike the federal funds rate, the 10-year Treasury yield reflects the global supply-demand balance of capital and can be disconnected from short-term domestic rates for various reasons. Rather than attempt to opine on the direction of global rates, we interpret the multi-trillion dollar fixed income market to best understand investor expectations. Perhaps surprising to many, the bond market assumes that the 10-year Treasury yield will climb from the recent rate of approximately 1.55% to 1.80% by the end of 2017 and 2.00% by the end of 2018. In other words, if the historical mortgage rate spread holds as we would expect, the 30-year fixed mortgage rate could be expected to approach 3.75% by the end of 2018, lower than the 2015 average of 3.85% and despite an expectation for continued FOMC tightening.

To be clear, there is obviously no guarantee that the global bond market has the “right” answer, but trillions of dollars of cumulative investment have conveyed that to be the most likely scenario at this point. Our simple message is to be careful with articles or analyses that tie FOMC actions directly to mortgage rates and implications on homebuyer activity.

Friday, September 9, 2016 by Zelman & Associates

Filed under: mortgage rates

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey