Apartment-Centric Population Expected to Trail Modestly Over Next Decade

Friday, October 7, 2016 by Zelman & Associates

Filed under: apartmentsdemographicsmillennials

We define the “Millennial” generation as those born between 1984 and 2002, making them 14-32 years old at present. According to the Census Bureau, there are approximately 83.5 million people in the United States in this age cohort, representing the largest absolute figure in history.

However, as it relates to housing demand, it is important to put the size into perspective. As of 2015, 26% of the population was aged 14-32, which compares to 26% in 2010, 27% in 2000, 30% in 1990 and 34% in 1980. Despite the large number of Millennials, the shrinking share relates largely to the aging of the Baby Boomers.

Given that young adults are more likely to be in school, unmarried and child-less, their choice of shelter skews more heavily to smaller, multi-family units than single-family homes. Thus a proper understanding of the growth outlook for the young is important to any housing-demand model. However, while these young adults gain the majority of the attention, all age cohorts are exposed to multi-family living and should be incorporated into the analysis.

For this reason, we developed what we define as the “apartment-centric” population, which weights the adult population by the propensity of specific age cohorts to reside in a multi-family unit. For example, while 14% of the adult population lives in a traditional multi-family building, this ranges from 10% of 55-59 year olds to 24% of 25-29 year olds. Thus, stronger growth in the population of 25-29 year olds matters more than similar growth for 55-59 year olds. Our weightings are driven by living situations from the last three years and held constant through time for direct comparability.

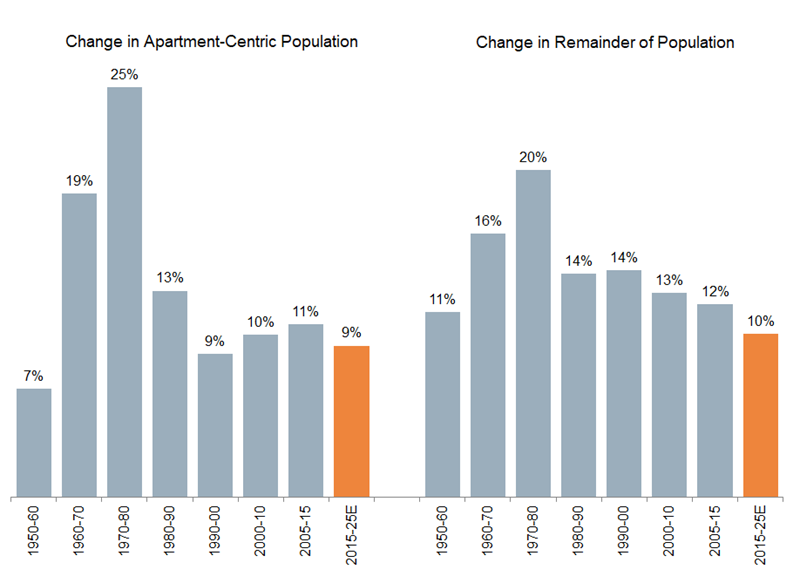

In 2015, the total adult population increased 1.0%, stable with 2014 and 2013. Apartment-centric population trailed modestly, up 0.9%, after also increasing 1.0% the prior two years. Utilizing Census Bureau population forecasts, apartment-centric population is projected to increase 9.3% over the next ten years, slightly softer than 10.0% for the remainder of the population. This does not capture any secular shift of age cohorts increasingly choosing multi-family housing at a specific point in their lives, which would be a tailwind to apartment demand, and it also does not reflect the unwind of cyclical effects that were the result of the Great Recession, which would be a net negative to apartment demand.

In summary, we believe that demographics can drive strong household formation in the near-term across the various types of housing – single-family owned, single-family rental, multi-family and manufactured housing – but we caution against over-extrapolating the Millennial effect solely as it relates to the apartment sector.

Friday, October 7, 2016 by Zelman & Associates

Filed under: apartmentsdemographicsmillennials

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey