Mixed Results for Housing-Related Stock Prices in 3Q16 and Year To Date

Friday, October 7, 2016 by Zelman & Associates

Filed under: stocks

Zelman & Associates produces stock price indices for eight sectors where it provides equity research coverage, presently capturing almost 90 companies. In the third quarter, the S&P 500 index appreciated 3% while the 10-year Treasury yield was volatile but climbed 11 basis points to 1.60%.

Amid that backdrop, only mortgage insurance (up 29%) and building products (up 4%) stock prices surpassed the broader market. Conversely, the weakest performance was by real estate services (down 8%), led by Realogy Holdings. The other five sectors were relatively stable for the quarter and underperformed the S&P 500, including the homecenters (down 2%), apartment REITs (down 1%), title insurers (down 1%), homebuilders (flat) and single-family REITs (up 2%).

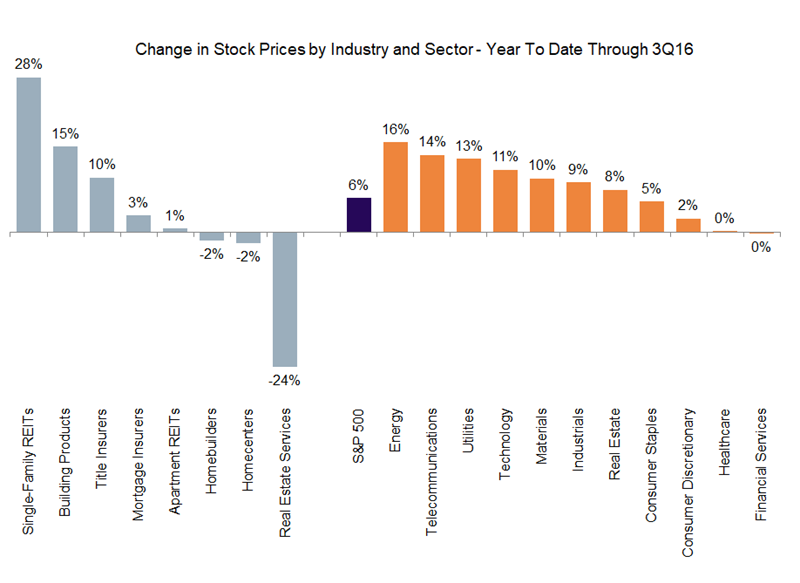

Year to date through the third quarter, the S&P 500 index returned 6% to investors, led by energy (up 16%), telecommunications (up 14%), utilities (up 13%) and technology (up 11%). Meanwhile, financial services (flat), healthcare (flat), consumer discretionary (up 2%) and consumer staples (up 5%) have underperformed the most.

For housing-related equities, single-family REITs (up 28%), building products (up 15%), title insurers (up 10%) and mortgage insurers (up 3%) were strongest, while the weakest performance was posted by real estate services (down 24%), the homecenters (down 2%), homebuilders (down 2%) and apartment REITs (up 1%).

Friday, October 7, 2016 by Zelman & Associates

Filed under: stocks

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey