Size of New Single-Family Homes Starting to Decline on Entry-Level Push

Friday, October 21, 2016 by Zelman & Associates

Filed under: entry-levelnew home sales

On a quarterly basis, we aggregate a significant sample of new homes listed for sale by production builders to gauge the trends in price point availability, pricing trends and general characteristics of the homes. In 3Q16, our sample approximated 20,000 homes, representing 8-9% of national production inventory. The median home of our sample included 2,560 square feet, four bedrooms and three bathrooms, costing $363,500.

Through the first three quarters of 2016, the median new home for sale across our analysis was 2,557 square feet, down 2.5% year over year. This was largely driven by 28.5% of homes being less than 2,250 square feet, which increased by 270 basis points from the comparable period in 2015 as homebuilders have put a greater emphasis on the first-time homebuyer segment amidst strong demand and a shortage of supply.

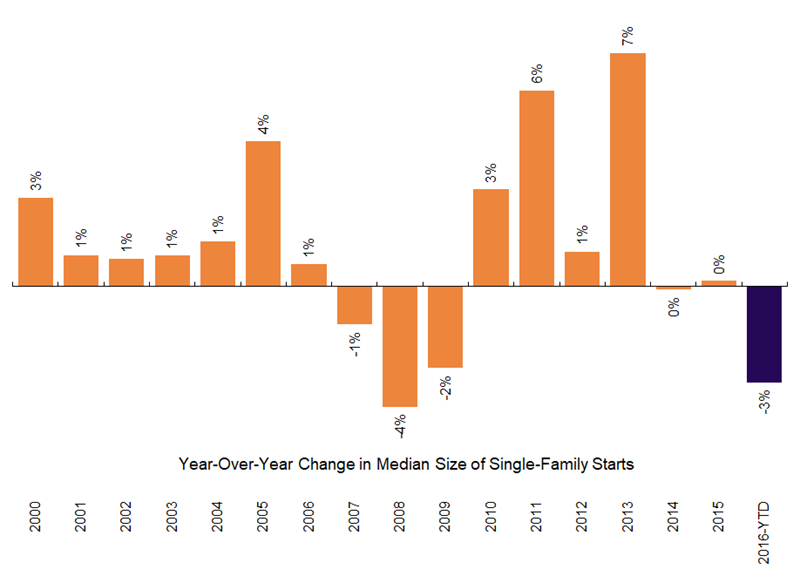

While third quarter figures from the Census Bureau have yet to be released, the trend of our analysis through the first half of the year directly aligns with national estimates. For instance, the Census Bureau reported that the median single-family home started in 1H16 was 2,430 square feet, including production and custom homes. That was down 2.8% from 1H15, which compares to a 2.9% decline for our sample. If the decline reported by the Census Bureau held for the entire year, it would represent the largest annual decrease since 2008 and the second largest of the 17 years we have data.

In our opinion, a rising share of smaller homes is likely to remain a theme for the foreseeable future as homebuilders become increasingly comfortable with the marginal risk of opening communities further from employment hubs. If sustained, this should facilitate stronger overall growth in single-family new construction and we believe it is the most important catalyst to drive production from a trailing 12-month pace of 765,000 units closer to normalized demand that we estimate at 1.0-1.1 million.

Friday, October 21, 2016 by Zelman & Associates

Filed under: entry-levelnew home sales

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey