Can Tighter Bank Lending Prevent Multi-Family Oversupply Problem?

Friday, November 4, 2016 by Zelman & Associates

Filed under: apartmentsconstruction lending

As of 2Q16, the entire banking system held almost $400 billion of loans backing the acquisition, construction and development (AD&C) of residential and non-residential land and buildings. Over the last year, 16% growth led all major loan categories, easily outpacing income-producing real estate, commercial and industrial, consumer loans and single-family mortgages. Each quarter, Zelman & Associates surveys lenders to gauge the underlying demand and availability of this credit.

In 3Q16, AD&C credit availability was rated at 60.1, declining from 62.9 in 2Q16 and 70.0 in 3Q15. The current rating still reflects strong availability but is at the lowest level since 3Q13 as a cautious shift in multi-family lending has been a material drag on the aggregate figure.

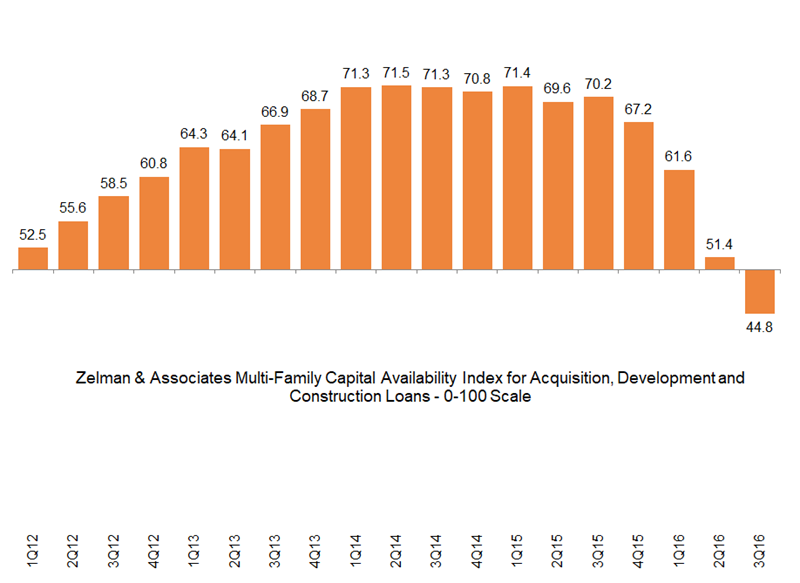

For example, our multi-family availability index dropped to 44.8 in 3Q16, below the key 50.0 threshold for the first time since 4Q11 and suggestive of a contraction in availability. Our index has slid seven of the last nine quarters since peaking at 71.5 in 2Q14. The year-over-year decrease of 25.3 points is far in excess of non-residential at down 11.3 points and single-family residential at down 5.0 points.

The catalyst for the substantial contraction in lender interest is mounting new supply, particularly in urban core markets, where the banks have been heavy participants in recent years. In addition, given elevated exposure to the sector, the regulators are more heavily scrutinizing incremental transactions and banks are hesitant to toe the line of high volatility commercial real estate (HVCRE) thresholds. According to one bank lender, “funding by large banks is still restricted due to full portfolios in the asset class and concern on meeting pro-forma rents on existing projects in some locations. Rents appear to be leveling off with slower growth in several markets due to the amount of units coming on line.”

While the pullback in lending is very evident, the effect on the market is less so. Some argue that the shift is material enough to prevent an oversupply situation from developing or limiting forward risk beyond the current pipeline of deliveries. We instead remain concerned that the pipeline of projects under construction or approved and nearing construction is already sizeable enough to drive a continued deceleration in fundamentals, especially in the urban core. Additionally, despite higher equity requirements (35-40%) and interest rates now required by banks, our contacts have highlighted that other forms of capital are stepping in to offset the reduction in bank appetite, suggesting that the overall contraction in availability might not be as extreme as our survey implies.

Friday, November 4, 2016 by Zelman & Associates

Filed under: apartmentsconstruction lending

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey