Finally, Excess Mortgage Distress is Gone

Friday, November 18, 2016 by Zelman & Associates

Filed under: homebuildinghousing startsmortgage

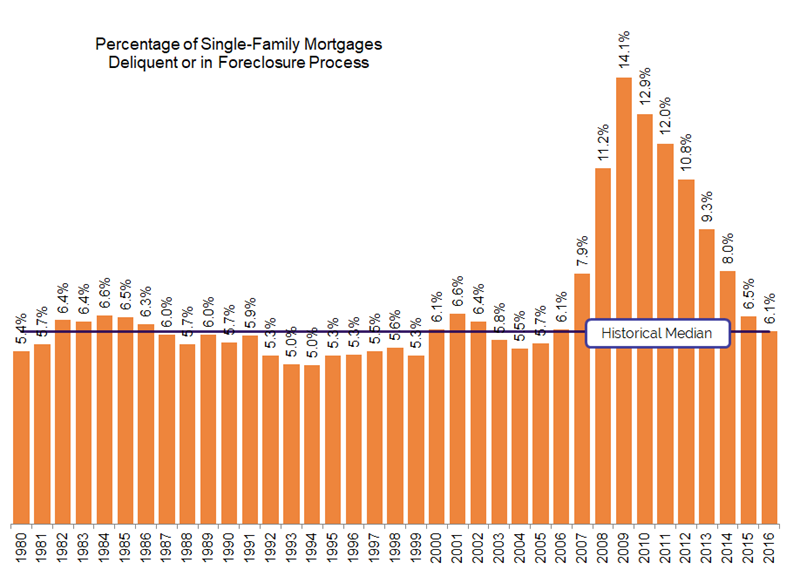

According to the Mortgage Bankers Association, from 1980 through 2005, the combination of single-family mortgage delinquencies and foreclosures in process ranged from 5.0-6.6% with the most problematic periods being 1982-86 (6.4%) and 2000-02 (6.4%). Driven by this relative historical normalcy, the foreclosure crisis that subsequently ensued was both unexpected and unprecedented.

With distressed mortgages peaking at an astounding 14.1% in 2009, the housing market faced a need to absorb excess inventory like never before. We believe this was responsible for the outsized drop in single-family construction from 2005-09 (74%) versus 1986-91 (29%) and 1978-82 (53%).

While many industry participants would prefer to forget about this past, we revisit the discussion because 3Q16 distress statistics just released indicate that single-family delinquency and foreclosure rates have returned to historical norms for the first time since the crisis began. Just as excess distress limited the need for new construction during the initial stages of the recovery, normalization in this part of the market should be critical to returning single-family starts to historical norms.

Specifically, national delinquency and foreclosure rates measured 6.1% in 3Q16, exactly on par with the 1980-2015 median. This means that excess distress is gone. With less competition, we expect single-family new construction to reclaim lost share of transactions. For example, in 2016, we estimate that new construction will account for 13% of all home closings, far below the 1990s at 26% and the 2000s at 21%. Without the competition from excess vacancies, we anticipate this gap to close meaningfully in the coming years, which is a clear positive for single-family homebuilders.

Friday, November 18, 2016 by Zelman & Associates

Filed under: homebuildinghousing startsmortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey