Public Single-Family REITs, a Real Business Here to Stay

Friday, November 18, 2016 by Zelman & Associates

Filed under: institutional investorssingle-family rentalsurvey

Over the last two weeks, the public single-family REITs reported third quarter earnings. Including American Homes 4 Rent (AMH), Colony Starwood Homes (SFR), Silver Bay Realty Trust (SBY) and Tricon American Homes (TAH), the companies own approximately 95,000 rental homes, which is small in the context of the overall single-family rental market at almost 16 million but provides a unique perspective on the strength of the asset class.

In 3Q16, rents increased 4.1% year over year for tenants that were renewing their lease and 5.5% for homes where a new tenant signed a lease, as compared to the prior tenant. Blending the lease activity for the quarter resulted in average rent growth of 4.6%. Occupancy was above 95% for all four REITs, averaging a healthy 95.8% and supporting the above-average pricing power.

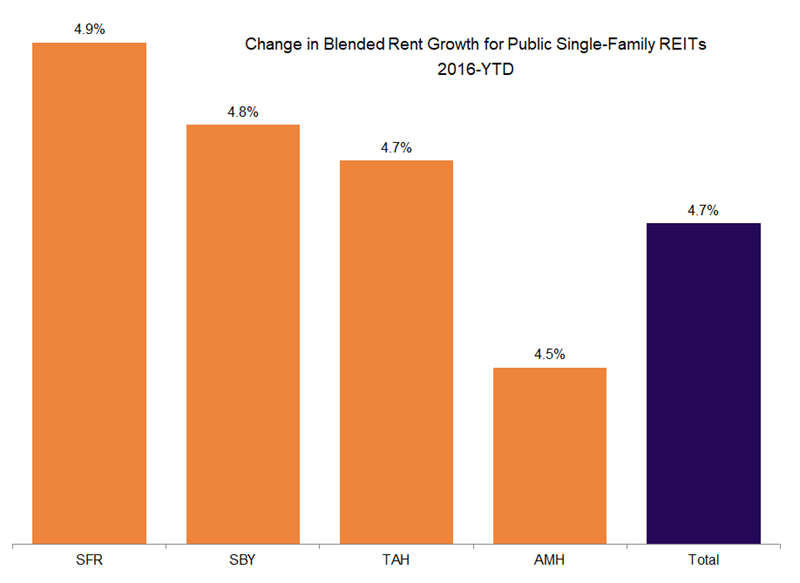

Similarly, year to date, rent growth for these companies averaged 4.7%, reflecting strength in the asset class due to strong household formation and limited supply. Speaking to the breadth of the market tailwind, year-to-date blended rent growth was nearly identical across the REITs at 4.9% for SFR, 4.8% for SBY, 4.7% for TAH and 4.5% for AMH.

For further perspective, participants in our single-family rental survey reported 3.9% year-to-date rent growth through September, stronger than each of the last four years that ranged from 3.1-3.6%. These companies are more nationally diverse than the public REITs, explaining a portion of the absolute variance in rent growth. Nevertheless, we believe that both data series highlight yet again that demand for single-family housing is outpacing the supply.

Overall, we remain optimistic that above-average rent growth can persist for the industry given the forecasted demand-supply mismatch. Although the industry is often positioned as at odds with the single-family ownership market, we believe that any risk relates to turnover and the associated expenses rather than occupancy. The reasoning being that when a household leaves a single-family rental unit for an owned home, net occupancy for the overall single-family asset class is unchanged. More pressing for single-family REITs would be acceleration in single-family starts growth but tight labor has been the most notable governor to a quicker ramp in supply.

Friday, November 18, 2016 by Zelman & Associates

Filed under: institutional investorssingle-family rentalsurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey