Why We Believe the Homeownership Rate Has Bottomed

Friday, November 4, 2016 by Zelman & Associates

Filed under: homeownership

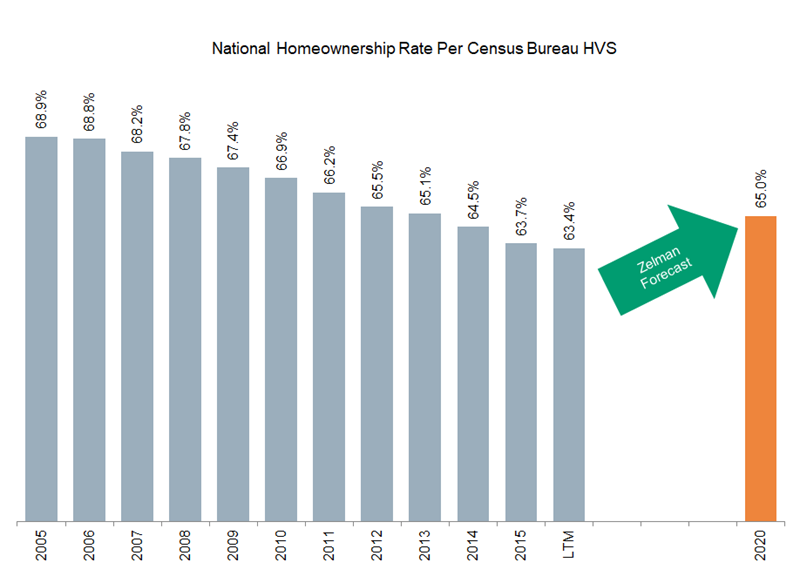

For 3Q16, the Census Bureau reported that the national homeownership rate, as measured by its quarterly Housing Vacancies and Homeownership Survey was 63.5%, up from 62.9% in 2Q16, with about half of the improvement due to typical seasonality and half related to core strength. While the trailing four-quarter average of 63.4% is the lowest level since 1966, we believe that the rate is at or near a trough for several reasons.

First, the resolution of legacy foreclosures continues to impact the reported homeownership rate. Excluding these households, we estimate that the homeownership rate would already be flat-to-up versus the prior year.

Second, young adults have historically had the most cyclically-sensitive movement in homeownership rates, which aligns with them being early in their career, having less savings and being more tied to the marginal employment environment. Given a recent increase in births and family formations, strong young adult employment and visible outperformance in entry-level home sales, we believe that young adult homeownership rates should begin to improve in the near future.

Lastly, we forecast the average age of householders to increase 3-4% over the next ten years as the baby boomers age, a positive mix benefit as older households have the highest homeownership rates. This approximate 100 basis point benefit over the next decade should largely be offset by faster growth among minorities that hold a below-average ownership rate but we find that some analyses focus on the negative of the latter without incorporating the positive of the former.

In aggregate, income growth and the macroeconomic cycle will be important factors behind the trend in homeownership rates, and the cyclicality of those factors are difficult to predict, but if we were forced to wager, we believe that the nation is more likely to see a return to a 65.0% homeownership rate over the next 5-10 years than a further drop to 60.0%.

Friday, November 4, 2016 by Zelman & Associates

Filed under: homeownership

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey