Will President-elect Trump Help or Hurt Housing?

Friday, November 18, 2016 by Zelman & Associates

Filed under: macro housing

Much has already been written about the impact of President-elect Trump and the broader economy, including as it relates to tax reform, infrastructure investment and foreign trade. All of these macro factors will have important implications for the employment backdrop and consumer confidence, and indirectly housing. More pointedly, we are focused on four key uncertainties that could have a material effect on the housing and mortgage markets, depending on how far they might be pushed to the extreme, including (1) deregulation; (2) mortgage rates; (3) GSE reform; and (4) immigration policy.

First, deregulation related to housing would most likely tie to either Dodd-Frank and the Consumer Financial Protection Bureau (CFPB) or the pursuit of lenders via the Department of Justice (DOJ) for legacy failures and minor infractions. We believe that many regulations put in place after the housing crash have been justified, including stronger mortgage underwriting guardrails and higher capital requirements that are positives for the longer-term health of housing. However, the cost of compliance and the uncertainty caused by the DOJ are heavy burdens that we believe could be lessened without sacrificing the intent. This is an area that the Trump administration could likely have the most positive impact on housing.

Second, a more optimistic lending community would have to be balanced against the perception of stronger employment and wage growth, which could drive up long-term interest rates and thus mortgage rates. Whether depressed global yields will allow higher U.S. interest rates is a separate debate, but since the election, the 30-40 basis point increase in the average 30-year mortgage rate highlights this risk. If rates continue to trend higher and refinance demand shrinks further, history says that mortgage lenders are likely to get more competitive, offsetting some of the macro headwind. Nevertheless, in our view, despite favorable entry-level affordability, mortgage rate volatility is a negative for consumer confidence and home purchases.

Third, while longer-term GSE reform is more likely under a Republican administration, we believe that it is unlikely that any material changes will be attempted in the next two years. Although the GSEs still face many critics within Congress, the entities are functioning well, driving cash flow to Treasury and are viewed to be supporting an important engine of the economy. Not to mention the inability to find compromise within parties previously when it was topical. GSE reform rhetoric might accelerate in the coming years, but it will be difficult to accomplish with no clear solution in front of lawmakers.

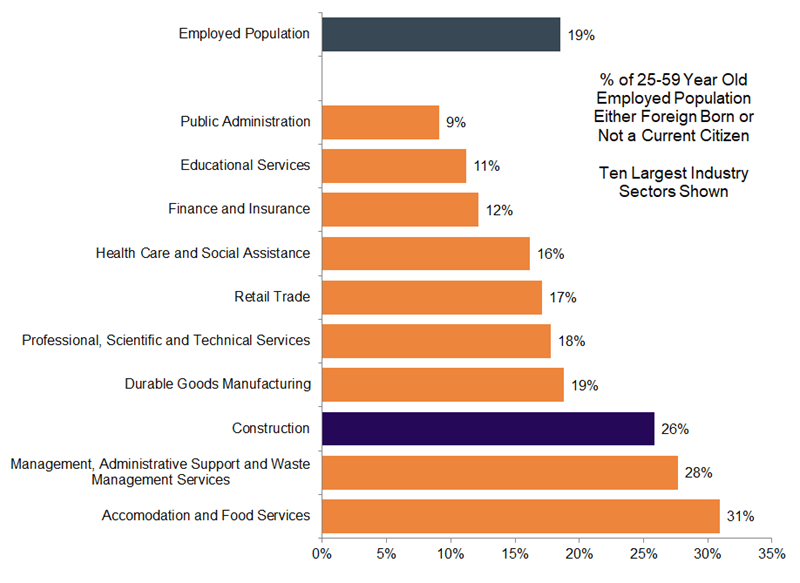

Lastly, immigration reform carries the most uncertainty and risk to the housing market, in our opinion. For perspective, immigration accounted for approximately 35-40% of population growth last decade, roughly evenly split between legal immigrants and an estimate for illegal immigrants. Any actions taken to damage the attractiveness of this country for foreigners could have a direct and prolonged impact on housing demand. In addition, 26% of 25-59 year old construction labor was born outside the United States, the third highest share among the ten most important employment sectors and 40% above the national average at 19%.

As a result, while construction-related labor is presently expanding at twice the national average as wages improve, the demand opportunity is accelerating and the industry is finally investing in ways to attract talent, attempts to limit immigration or deport illegal residents already in the country would have a disproportionate impact on the housing sector and the current momentum on the labor front.

We are cautiously optimistic that none of these items will be pushed so far as to undermine the housing recovery and assume the net effect of the various moving pieces is positive for the sector, but we also acknowledge that uncertainty is now higher.

Friday, November 18, 2016 by Zelman & Associates

Filed under: macro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey