Will the Recent Increase in Interest Rates Short Circuit the Housing Recovery?

Friday, December 2, 2016 by Zelman & Associates

Filed under: macro housingmortgage rates

Of the various interest rate measures cited in the media, the United States 10-year Treasury yield is the most important to monitor for the housing market as it serves as the benchmark for how 30-year fixed rate mortgages are priced. Unfortunately, the drivers of the 10-year Treasury are numerous and complicated, including the outlook for domestic and global economic growth, inflation and international capital flows.

The results of the U.S. presidential election have been the latest catalyst to shift forward expectations and the pricing of the 10-year Treasury. Specifically, since Election Day, the 10-year yield has climbed nearly 60 basis points to 2.45% from 1.88%, the most significant movement, up or down, in such a short amount of time since 2011.

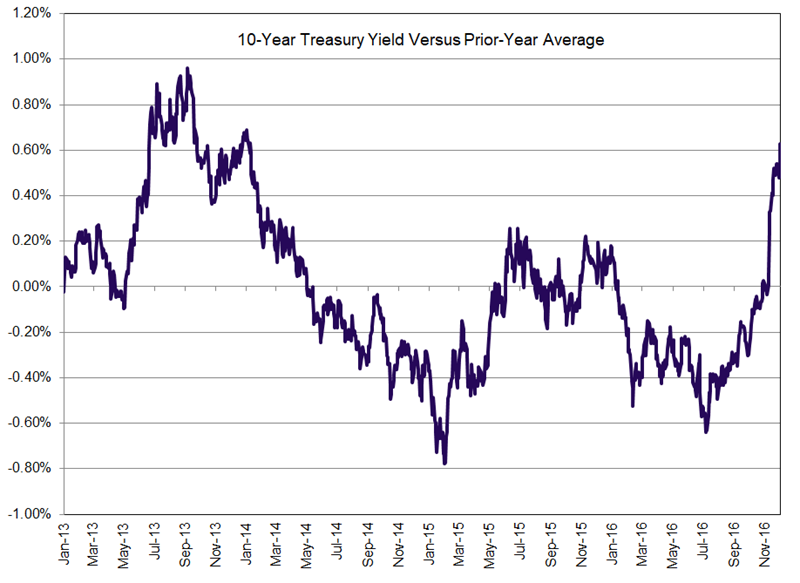

Volatility in the 10-year yield has been common in recent years, ranging from 1.37% in June after the United Kingdom voted to leave the European Union to 3.04% in January 2014. However, the extreme movement of late stands out over this period and is beginning to raise the question of whether short-term fundamentals are at risk.

For example, the current yield is roughly 60 basis points higher than the trailing one-year average. The only other time that this has been the case since 2011 was from June 2013 through January 2014. During that time, while the lag effect of higher rates varied by time series, growth in existing home sales, new home sales and single-family housing starts decelerated from strong double digits to flattish or negative territory.

While we are not complacent regarding a potential headwind to fundamentals from higher interest rates and are monitoring the real-time feedback from our proprietary monthly surveys closely, we believe that there are four primary factors that could potentially mitigate any negative effect.

First, in May 2013, the spread between the 10-year Treasury and 30-year fixed mortgage rate was 160 basis points versus almost 180 basis points in October 2016. As refinance mortgage demand wanes and originator capacity increases, this spread should compress and offset a portion of higher interest rates, unlike in the 2013-14 period.

Second, in May 2013, national existing home prices were up more than 9% year over year, with many areas of the country up strong double digits. As of this October, national prices were up closer to 5% and few major markets in the country were inflating at a double-digit pace. As such, the combination of higher prices and higher rates is less extreme today.

Third, the recent increase in interest rates is being fueled, justifiably or not, by economic optimism versus the 2013-14 spike that was largely tied to monetary policy uncertainty. We believe it is an important differentiation because consumer confidence is critical to outsized growth in the housing market and if slightly higher mortgage rates are accompanied by stronger economic activity and wage growth, any affordability constraints could be mitigated.

Lastly, many market observers might not appreciate that the macro and employment environment is on stronger footing today, as highlighted by an unemployment rate at 4.6% versus 7.5% in May 2013.

Time will obviously tell as to whether the recent spike in interest rates will be sustained, and if so, whether the consumer can overcome the financing headwind, but at this point we stand cautiously optimistic that the cyclical recovery in housing can continue.

Friday, December 2, 2016 by Zelman & Associates

Filed under: macro housingmortgage rates

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey