As Housing Stock Ages, More Tender Loving Care Required

Friday, January 27, 2017 by Zelman & Associates

Filed under: home improvement

We estimate that home improvement spending increased 5% across the country in 2016, representing the seventh consecutive annual increase after declining the previous three years. Since bottoming in 2009, we estimate that spending has increased 37% in aggregate. While this illustrates the cyclical and discretionary nature of the market, it also highlights how the majority of home improvement spending is unavoidable in the long term.

In other words, even during the deepest and darkest days of the Great Recession, households spent hundreds of billions of dollars on products and labor to maintain, repair or remodel their home. Without question, the discretionary piece of home improvement spending suffered significantly, but maintenance was difficult to avoid.

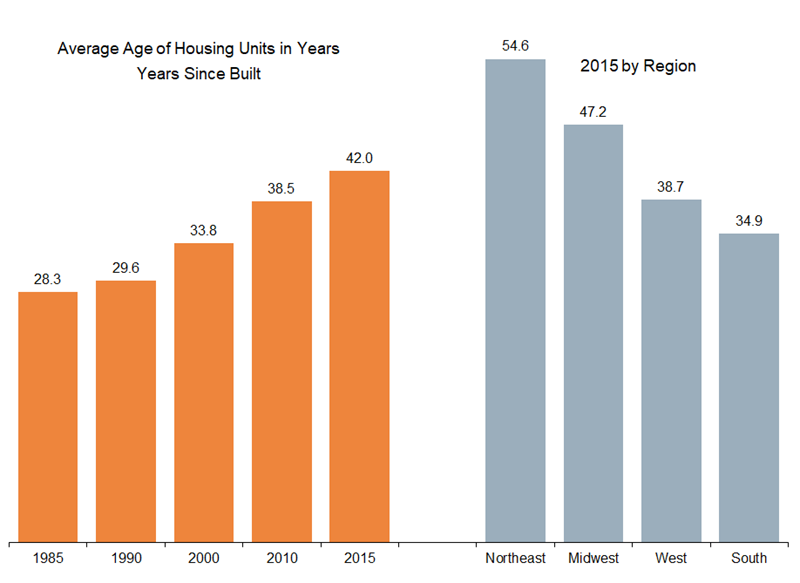

Along those lines, we believe that the aging housing stock is a secular tailwind to home improvement expenditures, above and beyond the current cyclical tailwind from a positive housing market. For instance, in 2015, the average housing unit was 42.0 years old, which compares to 33.8 years in 2000 and 29.6 years in 1990. Age by itself does not necessarily dictate repair and maintenance spending as a home originally built in 1960 could have undergone several major renovations to limit such maintenance requirements, for example. Nevertheless, we do believe that the two factors are aligned.

Consider that the age of the housing stock varies dramatically in accordance with the development of the country. The average unit was built 54.6 years ago in the Northeast and 47.2 years ago in the Midwest, with these two regions accounting for 40% of the nation’s housing stock. On the other hand, the average age was 38.7 years in the West and 34.9 years in the South.

Importantly, as one might expect, home improvement activity is more frequent in the Northeast and Midwest where the stock is older. Using data from the Census Bureau’s American Housing Survey from 2011 and 2013 – the most recent years available – reportedly 57% of owner-occupied households in the Midwest region had at least one home improvement project over the prior two years, on average. Next highest was the Northeast at 56%. The West and South trailed the national average at 53% and 50%, respectively, aligning with both regions having younger housing stock.

Certainly many factors are at play for homeowners and landlords when it comes to spending on maintenance, repairs or remodeling projects for their home, including the overall economic climate, discretionary income growth and the direction of home values. Even still, with many older homes lacking the desired floor plan or fashion of today’s homebuyer and maintenance probabilities rising, we believe an aging housing stock is yet another positive factor for overall home improvement spending that is both supported by intuition as well as our analysis of the underlying data.

Friday, January 27, 2017 by Zelman & Associates

Filed under: home improvement

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey