FHA Loans and Non-Banks a “Pocket of Worry” or Not?

Friday, January 27, 2017 by Zelman & Associates

Filed under: mortgage

Last week, the Wall Street Journal published an article titled “The Mortgage Market’s $1 Trillion Pocket of Worry”, which raised concerns about the expanding share of mortgages originated by non-bank lenders and originations backed by the Federal Housing Administration (FHA). While the article was not without merit, we believe it was misleading as it mingled the role of a mortgage originator and servicer while also implying undue credit risk with FHA originations.

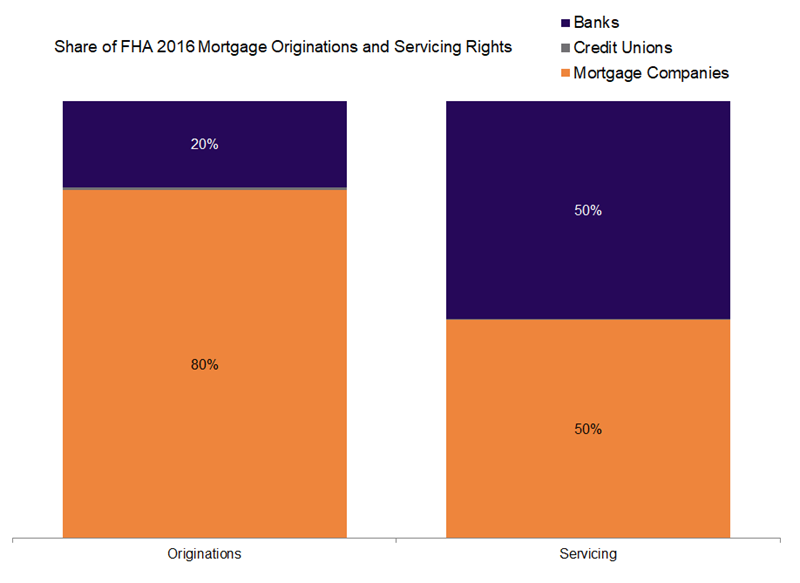

For example, in 2016, we estimate that non-banks (excluding credit unions) accounted for 51% of total unit mortgage originations, increasing from 47% in 2015 to the highest level since at least 1990. The share of FHA mortgage originations was even higher at 80%, up from 74% in 2015 and also at the highest level over the course of our dataset. However, share gains alone should not imply risk as banks and non-banks are bound by the same origination guidelines defined by the FHA and good and bad actors can sit on either side of the fence as has been the case in the past.

Separately, mortgage servicing risk does differ between banks and non-banks given that capital requirements are more strenuous for banks and liquidity for non-banks could be more problematic in the event of significant defaults as the servicer is still required to advance principal and interest payments to Ginnie Mae investors until the foreclosure is completed and the servicer is then reimbursed. As an aside, funding for many non-banks is provided by banks via their warehouse lending arms, so the two sides of the market are linked regardless, but any funding risk would still likely impact credit availability to consumers.

Looking separately at servicing rights, we estimate that non-banks service approximately 50% of outstanding FHA mortgages, lower than the origination share but still significant. As such, we believe that it is important to assess and implement appropriate capital measures for non-bank servicers and are encouraged that the government is not overlooking the issue, requiring HUD’s Office of Inspector General to complete an audit of non-bank Ginnie Mae servicers this year.

The last point to address is the implied credit risk of FHA mortgages. According to our estimates, FHA mortgages accounted for 13% of total dollar originations in 2016, up substantially from the 2% trough in 2005 when the agency lost market share intentionally to private label subprime originators by protecting underwriting guidelines, but not materially different from the 1990-99 average at 9%. Additionally, credit quality is worse in comparison to Fannie Mae and Freddie Mac with average purchase credit scores of approximately 685 last year versus the GSEs at 750, but this is to be expected given that the FHA is a social program targeted at affordable housing. In fact, FHA purchase credit scores last year are notably higher than 650-660 from 2000-02 and defaults among recent vintages are running at pristine levels.

To be clear, we do not worry materially about non-banks gaining market share of the origination or servicing market or their outsized exposure to FHA loans as banks’ faults during the credit crisis were largely responsible for the opportunity. However, we believe it is prudent for capital requirements and funding for Ginnie Mae to be assessed and adjusted for the new reality.

Friday, January 27, 2017 by Zelman & Associates

Filed under: mortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey