What is Impact to Home Improvements as Refinancings Collapse?

Friday, February 10, 2017 by Zelman & Associates

Filed under: home improvementrefinance

Since the presidential election, the 10-year Treasury yield has increased approximately 50 basis points, driving 30-year fixed mortgage rates up a similar amount. With the average 30-year rate in 2017 expected to increase at least 60 basis points, which would be the largest annual increase since 2000, it is projected that refinance demand will decline significantly.

As of our latest macro housing forecasts published in early December, we project a 33% decline in dollar refinance mortgage originations, which is more favorable than the down 45-55% forecast by Fannie Mae, Freddie Mac and the Mortgage Bankers Association. Regardless of the source, a substantial pullback is likely, which has raised the question about how this might impact home improvement spending that many assume is intertwined with home equity extraction.

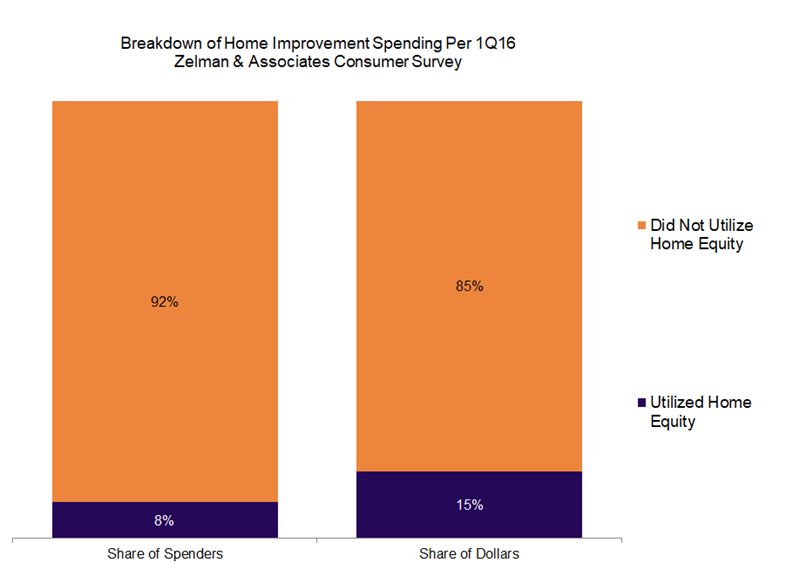

Positively, we expect the drag to be minimal based on our proprietary home improvement survey of over 1,000 homeowners that conducted a home improvement project. At this time last year, only 8% of these surveyed households funded their project in any way with a home equity loan, a home equity line of credit or proceeds from a cash-out mortgage refinancing. Not surprisingly, usage was skewed to big-ticket projects as 19% of those spending $5,000 or more tapped home equity.

Even if we assumed that those utilizing home equity funded the entire project with these sources, it would suggest that only 15% of total home improvement spending in dollar terms was dependent on all types of funding stemming from home equity.

Per Freddie Mac’s quarterly survey, approximately 40% of refinance originations in 2016 resulted in the borrower extracting cash, up from 34% in 2015 and still below the 1985-2005 median of approximately 55%. Thus, even though total refinance originations are likely to be down significantly, the cash-out piece is likely to take share. Furthermore, banking disclosures and commentary indicate that new home equity originations increased last year and we expect that trend to continue based on still-strong home price appreciation.

In aggregate, while fewer refinance originations would be a headwind to the extraction of equity for home improvements, we believe the impact is minimal in the grand scheme of the market that continues to be supported by elevated consumer confidence, above-average home price appreciation and a tailwind from a housing cycle that remains in expansion mode. As a reminder, we project total home improvement spending to increase 4.7% in 2017, similar to a 5.1% increase in 2016.

Friday, February 10, 2017 by Zelman & Associates

Filed under: home improvementrefinance

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey