Homebuilder M&A Gaining Steam with Foreign Companies Joining the Fray

Friday, March 10, 2017 by Zelman & Associates

Filed under: homebuilding

Over the last year, several Asian companies have gone on a buying spree of private U.S. homebuilders, including leading Japanese builder Sekisui House’s recent purchase of Woodside Homes. The Woodside deal, valued at $468 million or roughly 1.2 times book value, was noteworthy as it represents the largest acquisition in unit terms this cycle.

Prior transactions included Sumitomo Forestry’s acquisition of Edge Homes (Salt Lake City) in February, Daiwa House’s purchase of Stanley Martin (Mid-Atlantic) in October and at least four other acquisitions by Sumitomo dating back to 2015 (MainVue Homes in Seattle, Gehan Homes in Texas, Bloomfield Homes in Texas and Dan Ryan Builders in the Mid-Atlantic). In total, we estimate that the seven builders acquired by these three strategic buyers delivered roughly 7,000 homes in aggregate last year – roughly on par with Meritage Homes and Taylor Morrison for comparison purposes.

Up to this point, Sumitomo, Sekisui House and Daiwa House have acquired these companies and let the existing management teams continue running the show on a decentralized basis. Additionally, they have steered clear of acquiring public builders, likely due to the added complexities involved with buying a company with public shareholders and larger footprints. That said, we believe it is only a matter of time before public M&A accelerates and it is possible one of the less-liquid, small-cap public builders ultimately decides to sell – perhaps to a foreign investor.

Intuitively, foreign buyers are the ideal suitor for smaller builders as they are willing to keep existing management teams in place and should therefore be willing to pay more than a public U.S. builder, which generally view acquisitions as land transactions with little-to-no value ascribed to the organization. Additionally, we believe that Japanese and Chinese builders see U.S. expansion as an opportunity to bring superior building technologies to the States that are already prevalent in Asia.

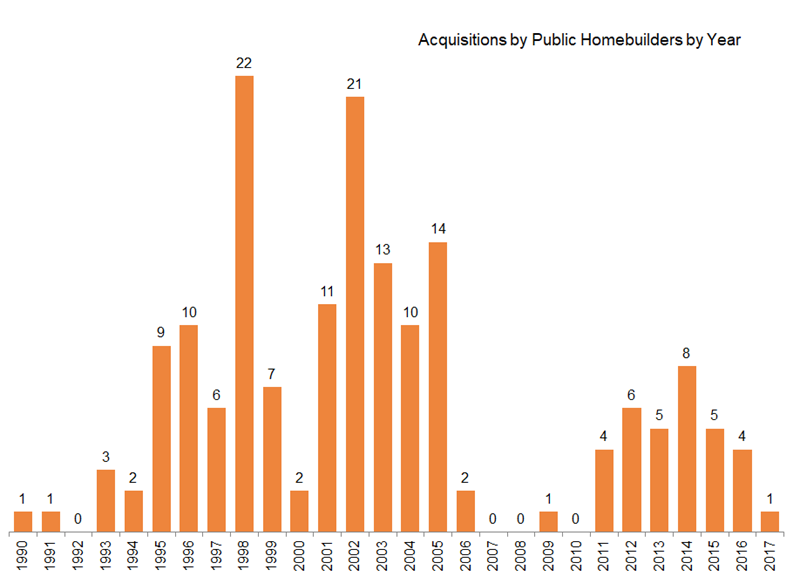

In addition to the incremental demand from international buyers, we believe the cycle is also approaching a point where public builder acquisitions are likely to take a step higher. There has been an average of five acquisitions by public homebuilders over the last six years versus 12 per year from 1996-2005, including two years where more than 20 deals were announced. The median net debt-to-capital ratio for the public builders stood at roughly 37% at year end, lower than 41% in the 2000s and 47% in the 1990s, suggesting ample financial flexibility to supplement existing land investment with acquisitions of private builders. Overall, we expect a busy M&A environment in the homebuilding community over the next several years.

Friday, March 10, 2017 by Zelman & Associates

Filed under: homebuilding

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey