Amidst a Lost Decade for Housing, What Does Future Hold?

Friday, April 7, 2017 by Zelman & Associates

Filed under: household formationhousing startsmacro housing

Every quarter, we publish in-depth macro housing forecasts and explanations covering single-family construction, multi-family construction, the existing housing market, home improvements and mortgage finance. With the release of our 1Q17 report and extension of our projections through 2019, the decade is coming into clearer focus and the negative picture is one that few could have predicted.

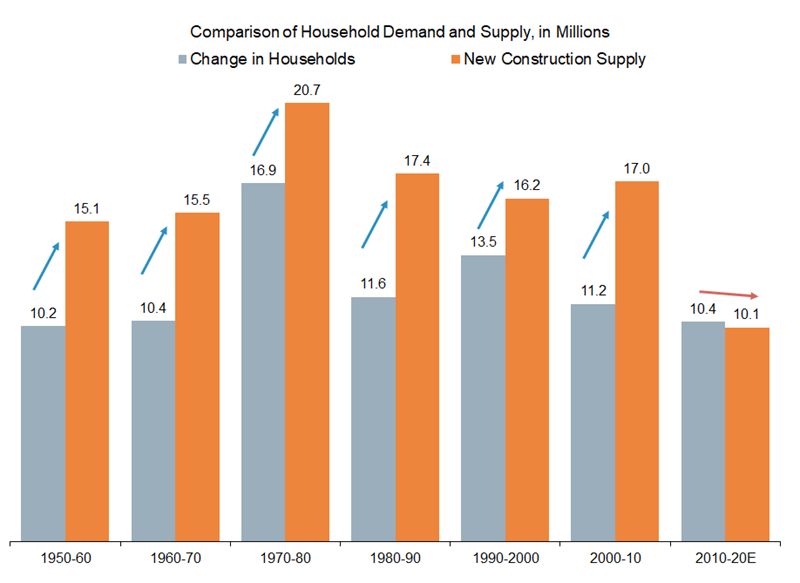

Based on 2010-16 production and our forecasts for 2017-19, we estimate that 10.1 million new construction units will be delivered this decade across single-family, multi-family and manufactured housing. This would be down 40% from last decade and an equal 40% below the average over the prior six decades. For all intents and purposes, one could consider this a lost decade for housing.

To be sure, new construction should have been under pressure this decade as overbuilding was significant through much of the 2000s. For example, the total vacancy rate stood at 11.4% as of the 2010 Decennial Census, implying 2.7 million more vacant units than normal, according to our analysis. This supply glut to start the decade was compounded by the aftermath of one of the worst recessions on record, which led to poor financial circumstances and delayed household formations for young adults.

Utilizing our proprietary analysis of household formations through 2016 and making rough assumptions for the next three years, it is likely that only about 10-11 million new households will be formed this decade. This means that new construction supply will be lower than household formation – a stark contrast with the prior six decades when new construction was 38% higher in aggregate, ranging from a 22-51% spread, which accounts for the impact of replacement demand and incremental vacant units for second homes or transitory stock.

While the sins of the last housing cycle continue to haunt the market, with excess vacancies all but absorbed, household formation running near our normalized estimates and pent-up demand still evident among young adults, the outlook is bright for new construction, in our opinion. Given near-term limitations on supply growth in the single-family market related to labor and land, we suspect that the aforementioned factors will result in an extended duration of the current recovery rather than significant growth in any one or two individual years. Our fundamental supply-demand analyses also provide us comfort that any interruptions from macro events – of which there are sure to be many – will more likely result in a pause in growth, rather than a contraction in the market.

Friday, April 7, 2017 by Zelman & Associates

Filed under: household formationhousing startsmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey