New York Federal Reserve Study Hits Interesting Points on Student Debt

Friday, April 7, 2017 by Zelman & Associates

Filed under: homeownershipstudent debt

Earlier this week, the New York Federal Reserve published a presentation on household debt with a focus on student loans. According to the analysis, there was $1.31 trillion of outstanding student debt at the end of 2016, up 50% over the last five years and 172% over the last ten years. These figures are striking on the surface, leading many to assume a significant headwind to housing and homeownership.

We believe it is important to understand the implications of rapidly-rising student debt, and we do not dismiss the potential challenge it could present to borrowers, but we also believe that the media narrative is more negative than appropriate. We found the New York Federal Reserve’s analysis to be balanced with several interesting data points worth highlighting as it pertains to housing.

First, there were reportedly 44 million borrowers holding the $1.31 trillion of debt, equating to $29,800 per borrower but the distribution was far from even as 5% of borrowers held 30% of total debt outstanding, with an average loan balance of $178,600. This would likely be heavily influenced by graduate degrees for doctors, lawyers and business professionals, that probably also carry the most promising income outlook, limiting net balance sheet risk. On the other side, 65% of borrowers are responsible for only 21% of outstanding debt, with an average balance of $9,600.

Second, each of the last seven years, approximately 55% of college attendees relied on student debt to some degree. The stability in this measure at the same time that total student debt outstanding is also rising significantly highlights that greater college participation rates (a good thing) and more expensive tuition (a bad thing) are the catalysts as opposed to a higher share of students requiring debt to pursue a college degree.

Third, as it relates to homeownership, the data confirm our prior stance that, all else equal, we’d rather bet on a college graduate with debt than a non-college graduate without debt. For instance, among 33 year olds, college attendees without debt had the highest homeownership rate at approximately 47%, followed by college attendees with some outstanding debt at 42-43% versus only 27% for individuals that never attended college. The favorable spread is true for every age beyond 25 with an expanding differential over time.

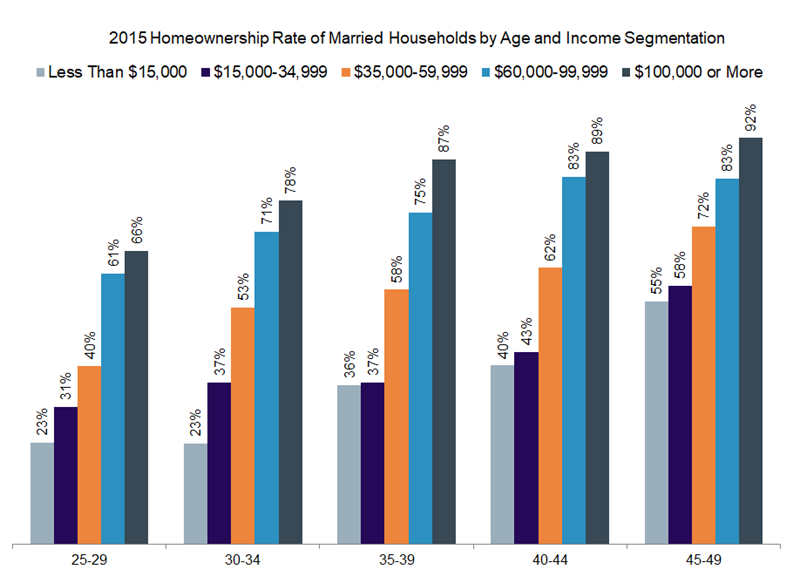

Aligning with this thought, homeownership is more dependent on income than any other variable, in our opinion. While there are clearly many exceptions to that statement, with some households with the necessary income choosing to rent, at a broad level, homeownership rates rise alongside household incomes almost without interruption. When looking at married households by age to normalize demographic circumstances, homeownership rates rise in step function of income in every instance within age cohorts, beginning with 20-24 year olds and holding true through 70-74 year olds. For this reason, while student debt is not without risk, particularly if graduation is not achieved, we accept higher debt balances as the necessary evil of an increasingly-educated young population knowing that higher income potential is the reward.

Friday, April 7, 2017 by Zelman & Associates

Filed under: homeownershipstudent debt

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey