Unique Beige Book Index a Better Read on Economy than GDP?

Friday, April 21, 2017 by Zelman & Associates

Filed under: macro housing

In 2016, real GDP increased 1.6%, tying 2011 as the weakest growth of the last six years. At the same time, the S&P 500 equity index was up a strong 10%, the annual unemployment rate was the lowest level since 2007 and consumer confidence was the highest since 2007. One question that comes to mind is whether real GDP is the best measure of economic health, particularly with domestic activity having shifted so significantly to services from manufacturing.

As an alternative to GDP, we developed a proprietary index that is derived from the Federal Reserve’s Beige Book report, which is released eight times a year and gathers anecdotal information on current economic conditions through interviews with key business contacts, economists, market experts and other sources. In essence, it is based on conversations with real people involved in running or analyzing businesses every day.

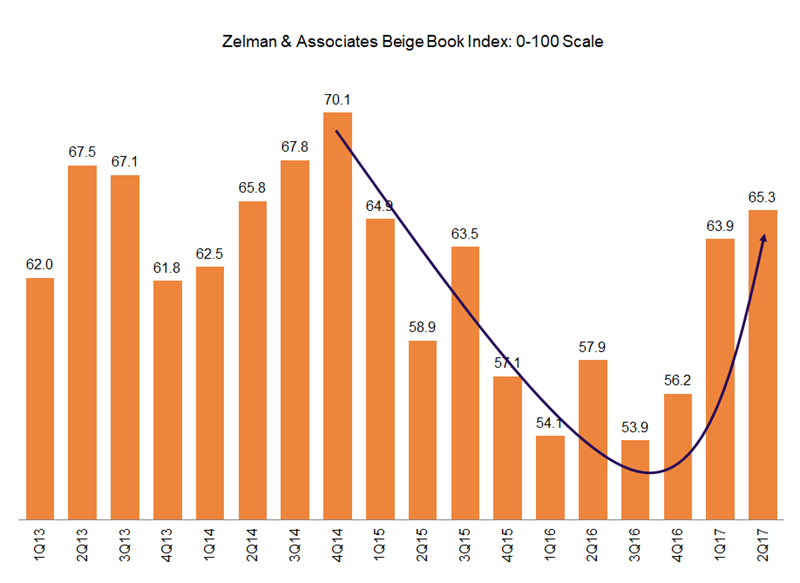

Our index is on a 0-100 scale and stretches back to 1970. The historical average has been 54.5, ranging from 23.4 in 1Q09 to 82.0 in 4Q72. Interestingly, historically, our index was very highly correlated to both real GDP and employment growth but the linkage with real GDP has weakened since 2010 while the correlation with employment growth has actually strengthened.

For the most recent Beige Book published this week, our index stood at 65.3, down slightly from 65.8 in March, but still positive in our opinion. For example, the current reading is still strong in the context of the last two years that ranged from 49.8 to 65.0. Additionally, the year-to-date average of 64.4 is easily ahead of 56.0 at this time last year and the best start to the year since 2013.

Like most other macroeconomic data, our index has inflected positively since the presidential election and the current pulse of the economy appears stronger than the 1.4% seasonally-adjusted pace of improvement in real GDP that is being estimated by economists. For this reason, as we digest macroeconomic headlines with an eye toward housing, we traditionally deemphasize GDP and instead prefer to focus on employment growth given its tight relationship with consumer confidence and household formation.

Friday, April 21, 2017 by Zelman & Associates

Filed under: macro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey