Urban-Focused Multi-Family Construction Creating Longer Tail Risk of Supply

Friday, April 7, 2017 by Zelman & Associates

Filed under: apartmentshousing starts

Unlike in the single-family market where permits and starts are largely reflective of current demand, on the multi-family side, permits and starts are influenced by current demand but they are still speculative in nature given that the product will not be completed and delivered to the market for 12-24 months.

Intuitively, multi-family completions are a function of what is started and the construction timeline associated with those starts, which is most dictated by geography, labor availability and product type. In 2016, the Census Bureau reported that 320,000 multi-family units were completed, flat with 2015 despite units under construction being up 11% to start the year. We believe this indirectly speaks to a lengthening construction timeline, which is important to understand because it suggests that the pressure from completions is likely to be more pronounced than what might be implied by starts alone.

As of February, 637,000 multi-family units were under construction, up 14% year over year and representing the highest absolute figure since October 1974. In addition to incremental starts, the pace at which this existing backlog is finished and delivered will ultimately dictate the burden of new supply on apartment fundamentals. Important to the analysis, the time differential between starts and completions has been extended in recent years as units under construction have skewed to larger buildings in urban locations that take longer to finish than suburban product.

For example, in 2016, there were 324,000 multi-family starts in buildings with at least 20 units, accounting for 83% of all multi-family starts. The 2014-16 average of 82% compares to 59% from 2000-09. Similarly, in 2016, approximately 150,000 multi-family completions were in buildings with at least four floors, equating to 47% of the total. From 2000-09, taller buildings averaged just 28% of completions.

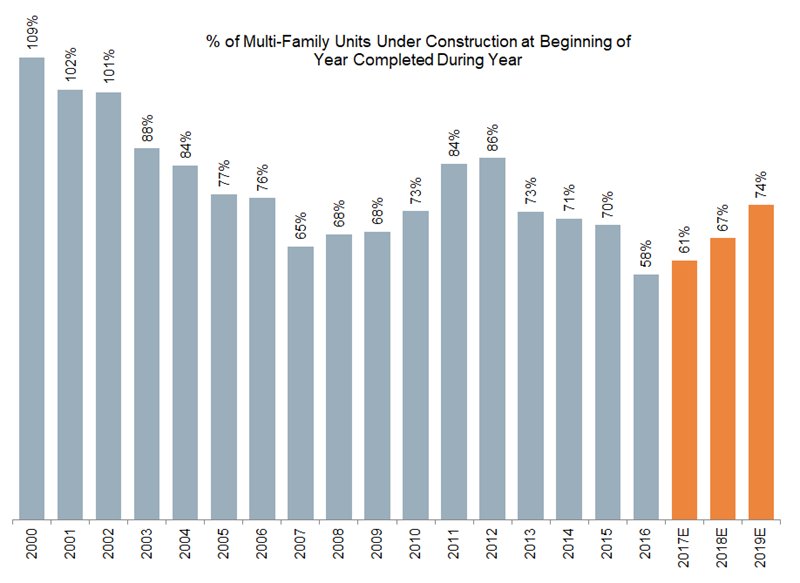

In our opinion, this push into urban environments has created longer tail risk to supply as completion timelines are extended and supply is more concentrated. Consider that in 2016, multi-family completions equaled only 58% of beginning backlog, the lowest level by far for the 45 years we have data. Even focusing on recent history, the 58% ratio easily trails the prior ten-year average of 73%. Thus, the overhang of future completions was more pronounced at the start of this year than any other point over the last four decades.

Reflecting our analysis of existing backlog and our starts forecasts over the next two years, we predict national multi-family completions to increase 16% in 2017 to 375,000, followed by 11% growth in 2018 to 415,000 and a 2% increase in 2019 to 425,000. The increases in 2018 and 2019 are in spite of starts projected to be down in both years given the heavy backlog that will still be delivering – a dynamic that we believe is underappreciated by the market.

Friday, April 7, 2017 by Zelman & Associates

Filed under: apartmentshousing starts

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey