Urban Sprawl Picking Up Steam Even Beyond Starter Homes

Friday, April 21, 2017 by Zelman & Associates

Filed under: entry-levelhomebuilding

Beginning in 1Q15, we began tracking new home for-sale inventory across more than 20 production homebuilders, including the square footage offered as a way to better gauge investments and the willingness to cater to the under-served entry-level segment of the market.

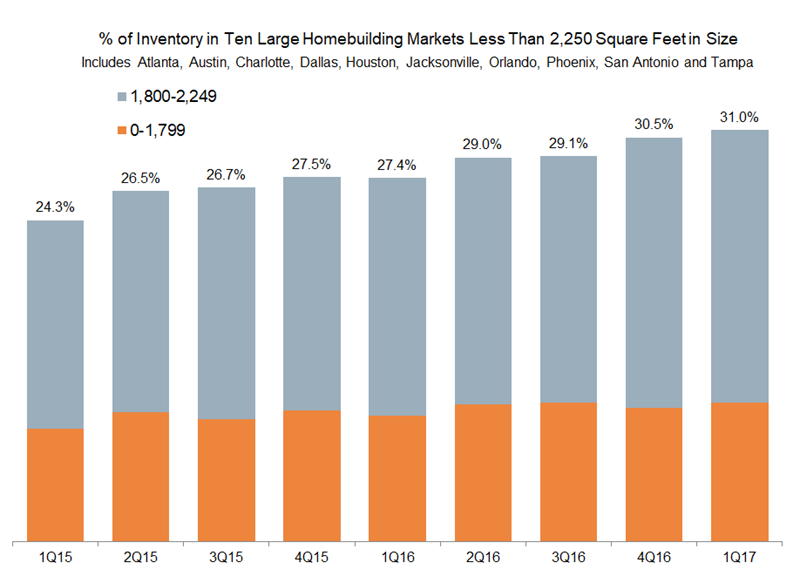

At that time, we argued that demand from entry-level buyers was stronger than perceived and suggested that greater supply at affordable price points would be welcomed by the market. However, in 1Q15, our analysis revealed that only 24% of new home spec inventory was less than 2,250 square feet across ten of the largest homebuilding markets in the country, on average.

Over the last two years, that dynamic has changed dramatically, as our analysis of these same ten markets in 1Q17 showed that 31% of for-sale inventory was less than 2,250 square feet. Importantly, the share gain for smaller homes has occurred alongside a growing market. For example, nationally, spec inventory under construction has increased almost 30% over the last two years. If our ten market sample were extrapolated to the entire country, it would imply that starter home spec inventory increased over 60%!

While this unfolding dynamic would have been heavily doubted two years ago as many builders perceived the risk of pursuing an entry-level consumer as too costly, exposure to the price point is now applauded by most given outsized growth in the channel.

Beyond the rising share of smaller floorplans, which highly suggests an increased entry-level focus that typically occurs in further-out rings of geographic areas, our 1Q17 analysis also indicates that builders are beginning to offer even larger product in these submarkets that would seemingly be more appropriate for a move-up buyer.

For instance, in 1Q17 across our entire sample, the median price per square foot increased approximately 3% year over year, roughly half of the 6% increase in comparable prices on new orders reported by private builders participating in our monthly survey.

The variance between these two numbers was the widest for the five quarters we have data, with the prior four periods averaging to just a 1% difference. In other words, builders appear to be introducing homes of all sizes in more affordable submarkets, creating downward pressure on the median price per square foot.

We believe that this serves as yet another sign that builder confidence is rising and incremental investments are being geared toward higher-volume areas, which should support the recovery of national single-family housing starts back toward more normalized levels.

Friday, April 21, 2017 by Zelman & Associates

Filed under: entry-levelhomebuilding

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey