Are New Home Prices Rising Too Quickly?

Friday, May 19, 2017 by Zelman & Associates

Filed under: affordabilityhome pricinghomebuildingsurvey

According to our monthly private homebuilding survey that canvasses approximately 15% of the national production market, new orders increased 14% year over year in April, the lowest rate of growth since October and below the 18% generated in 1Q17. We attribute at least a portion of the deceleration to the timing of the Easter holiday, although the month did benefit from one additional weekend day versus last year.

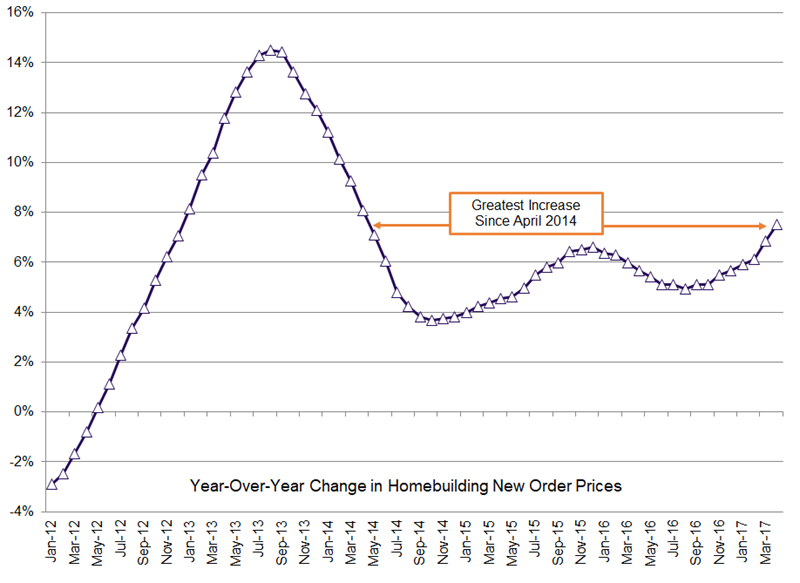

Smoothing for the calendar fluctuations, on a year-to-date basis, 17% order growth is 300 basis points better than for all of 2016, highlighting the improvement in demand since the presidential election. Additionally, the unit momentum has been accompanied by stronger pricing power as year-over-year new order prices were up 7.5% in April, easily stronger than 5.7% in December and representing the best pace since April 2014. Put another way, the 180 basis point improvement was the most for a four-month period since August 2013 when price appreciation was at 14.5%, a peak for the cycle thus far.

We attribute the robust pricing trends of late to: (1) strong unit demand; (2) tight for-sale inventory; (3) pressure on land, labor and building material costs; and (4) hesitancy of builders to extend backlogs too far given limited finished lot supply, restrictive labor availability and cost inflation risk. It is hard to argue with the output of a well-functioning market as the contract prices are obviously digestible by consumers, but we are starting to ask the question of whether prices are being pushed too far too quickly.

To be clear, in our view, the risk is not that affordability of potential entry-level homebuyers is unreasonable. In fact, we believe that affordability is still stronger today than historical norms when measuring the monthly payment for principal, interest and insurance against incomes. Rather, the concern arises from the compounding effect higher mortgage rates and escalating home prices can have on the near-term psyche of buyers, limiting confidence in the equation.

The benefit of rising home values is clear to the economy and existing homeowners as it filters through to stronger balance sheets and often greater discretionary consumer spending. However, the net loser is the entry-level buyer that is critical to the velocity of the entire housing market. At this point, we believe that the market can appropriately balance healthy unit volume and price appreciation, but to the degree home price inflation accelerates further, we believe macro choppiness becomes harder to navigate.

Friday, May 19, 2017 by Zelman & Associates

Filed under: affordabilityhome pricinghomebuildingsurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey