Lumber Inflation Surrounding Canadian Tariff Just Another Pressure on Builder Costs

Friday, May 5, 2017 by Zelman & Associates

Filed under: home pricinghomebuilding

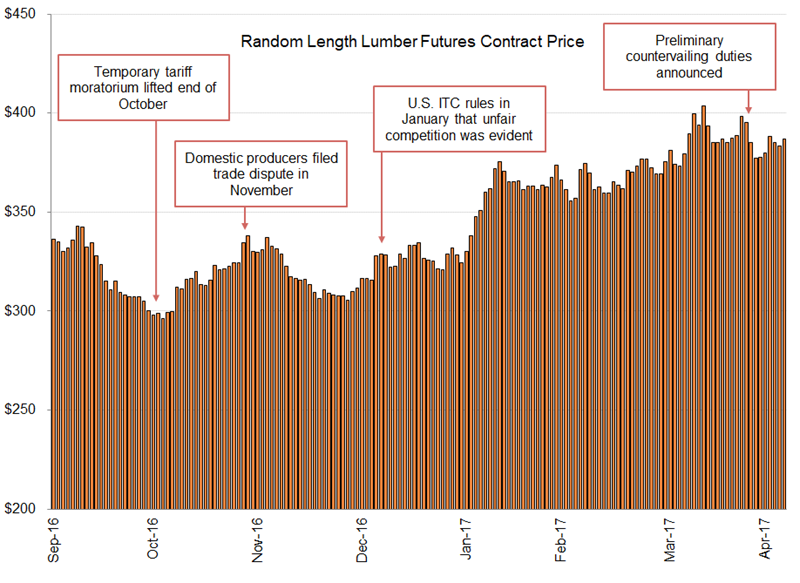

In late April, the Department of Commerce announced countervailing duties, or a tariff, on imported softwood lumber from Canada, ranging from 3-24% for the largest producers and 20% for all other mills. The tariffs were largely expected by industry participants given a unanimous vote by the U.S. International Trade Commission in January that there was reasonable indication of unfair competition, but the amount of duties was uncertain.

In anticipation of a tariff, U.S. framing lumber futures climbed almost 20% from January through early April; however, on the day the countervailing duties were announced, prices in the futures market declined 2% and finished April 6% lower than the year-to-date peak. In essence, the market was braced for the tariff and now that short-term rules of engagement are known, industry players can respond to supply and demand dynamics accordingly. So what does this mean for the cost of housing and homebuilders?

According to our homebuilding model, framing lumber accounts for approximately 4-5% of the cost of a typical home, exclusive of labor, equating to a $7-9,000 cost on a $225,000 entry-level home. Per Random Lengths, year-to-date framing lumber prices are up 21% on average while contracts on the futures market are up a more substantial 35%. This means that the cost on this home would climb by roughly $1,500-3,000, or 0.5-1.5%.

In isolation, the impact might appear digestible by builders, but this is only one of the many areas that costs are under pressure. According to private builders participating in our monthly survey covering 15% of the production market, labor and material costs were up 3.4% year over year in March, the highest level of inflation since November 2014, and for the most part, escalating lumber prices have yet to impact the income statement given the lag in prices filtering through to closings.

The overall cost increases reflect a tight labor market that is pressuring wages across the majority of specialty trades and rising raw material costs leading to price announcements by building products manufacturers in almost every major product area. For example, in our monthly survey of building products suppliers, covering over $95 billion of annual revenue, our 0-100 pricing index averaged 61.6 in 1Q17, excluding lumber. This was the highest first quarter level of our index since 1Q13, surpassing the average over the prior three years of 56.7.

Lastly, as reported in our 1Q17 land development survey, national finished lot costs were up 8% year over year, moderating slightly from recent quarters but compounding increases of 9% in 2016 and 11% in 2015.

In summary, while the Canadian softwood lumber dispute has garnered a disproportionate share of headlines of late, homebuilder cost pressures are present from numerous directions. Unfortunately for the consumer, given a shortfall of for-sale housing inventory, a significant share of these costs are likely to be absorbed in the purchase price. In 1Q17, new home order prices were up 6.3% on a comparable basis, according to our monthly survey, as compared to 5.5% in 2016, 5.3% in 2015 and 6.2% in 2014. Nothing on the cost side suggests alleviation on this front in the foreseeable future.

Friday, May 5, 2017 by Zelman & Associates

Filed under: home pricinghomebuilding

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey