Single-Family Rent Growth Has Overtaken Apartments After Historically Lagging

Friday, May 5, 2017 by Zelman & Associates

Filed under: apartmentssingle-family rentalsurvey

In 2016, we estimate that there were roughly 44 million single-family and multi-family rental homes across the country, accounting for approximately 35% of total households. To track the professionally-managed portion of each market, we conduct proprietary monthly single-family rental and apartment surveys, which we believe are geographically diversified and provide a unique perspective on the market.

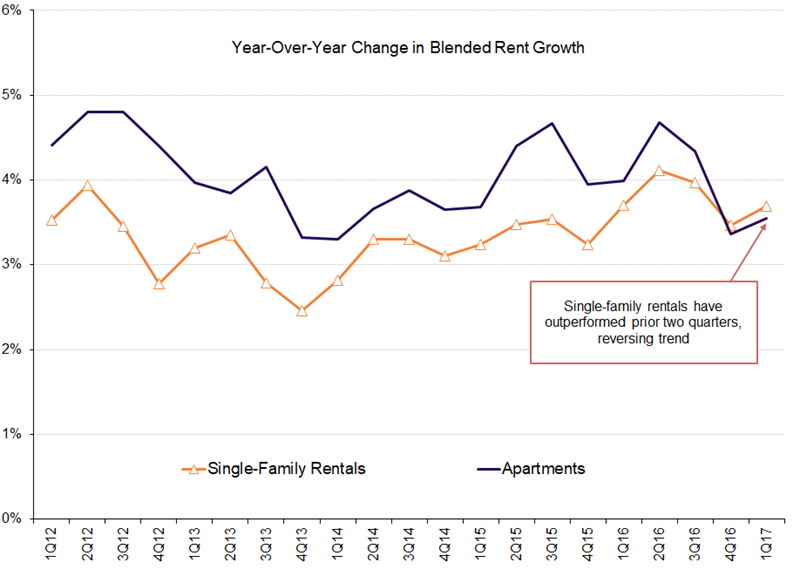

From 2012-15, rent growth for both sides of the rental market were stronger than historical norms and broader consumer inflation due to expanding household formation and tight overall housing inventory. Over this period, rent growth was strongest for participants in our apartment survey at a 4.1% annual average versus 3.2% for single-family landlords. The single-family shortfall was evident each of the four years and was relatively consistent at 50-120 basis points.

However, beginning in late 2016, this trend began to invert. In 4Q16, single-family rent growth of 3.5% surpassed apartment peers by 10 basis points. In 1Q17, single-family rent growth ticked higher to 3.7% with the relative performance versus apartments expanding to 20 basis points. The outperformance is obviously minor but we believe the reversal from underperformance the prior four years is worth noting. In our view, suburban multi-family rent growth remains strong alongside single-family rentals, but the pressure on urban properties due to a heavy dose of new supply is hindering overall sector performance.

Highlighting this dynamic, in our apartment survey, we ask respondents to quantify monthly pricing power relative to expectations, split by price point and geography. In 1Q17, on a 0-100 scale, urban class-A and class-B projects were rated at 47.1 and 46.5, implying modest disappointment versus expectations that were likely already depressed. On the other hand, suburban class-B properties scored 60.1, highlighting continued strength that was better than estimated.

For the rest of 2017 and 2018, we expect this bifurcation to persist given that single-family supply overall and multi-family supply in the suburbs continue to trail demand, leading to outsized home price appreciation and rent growth. Meanwhile, a substantial number of new apartment deliveries in urban core areas at elevated price points is likely to drive below-average pricing power through at least next year.

Friday, May 5, 2017 by Zelman & Associates

Filed under: apartmentssingle-family rentalsurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey