The Paradox of Household Formation and New Construction Supply

Friday, May 19, 2017 by Zelman & Associates

Filed under: household formationhousing starts

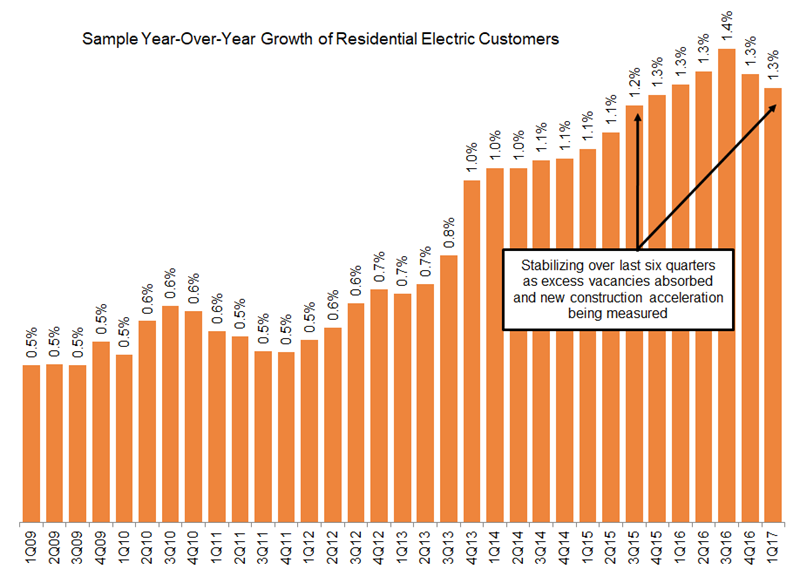

We utilize a proprietary tracking of residential electric customers to supplement our views on household formation, which has proven critical to our overall housing thesis during periods of volatile government data.

In 1Q17, our quarterly sample of public electric utility providers covered almost 30 million residential customers, which accounts for roughly 23% of the national total and offers a robust sample to gauge country-wide trends. For the quarter, year-over-year growth registered 1.3% on a rounded basis, consistent with four of the prior five quarters. Triangulating residential electric customer trends with other data, we estimate that annualized household formation is holding steady near our estimates for 2016 (1.36 million) and 2015 (1.33 million).

For comparison, the Census Bureau’s Housing Vacancy Survey (HVS) for 1Q17 reported 1.22 million new households were formed since 1Q16. While that figure is not significantly different than our current run-rate estimate, it’s materially above the 0.88 million pace reported by the HVS last year – implying volatility that we do not believe is prevalent in underlying demographics.

Assuming our model is correct and that another 200,000 units of demand is created each year for homes lost to intentional knockdowns, natural disasters or obsolescence, total housing demand is approximately 1.55 million today, still far ahead of the approximate 1.20 million new supply pace based on housing starts and manufactured housing shipments. However, now that excess vacancies are balanced, in our opinion, a paradox exists between household formation and new construction requirements.

In other words, housing demand does not translate directly to household formations if inventory is not sufficient enough for those households to actually be formed. Thus, it is a catch-22 – which accelerates first, household formation or new construction supply? In our opinion, accelerating home price appreciation is a clear sign that more new construction is necessary, particularly for single-family dwellings. More patience is likely required this cycle due to land and labor constraints, but we do not believe that this changes the fundamental argument for strong new construction growth ahead. Just as the downturn lasted longer than most anyone would have assumed, we believe the same will be true for the recovery.

Friday, May 19, 2017 by Zelman & Associates

Filed under: household formationhousing starts

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey