Don’t Be Confused, A Good Time to Sell is a Good Thing to Hear

Friday, June 16, 2017 by Zelman & Associates

Filed under: home pricing

Beginning in mid-2010, Fannie Mae began publishing a monthly survey of approximately 1,000 households, canvassing various perceptions related to the housing market and economy. One of the questions asked monthly is: “In general, do you think this is a very good time to sell a house, a somewhat good time, a somewhat bad time, or a very bad time to sell a house?”

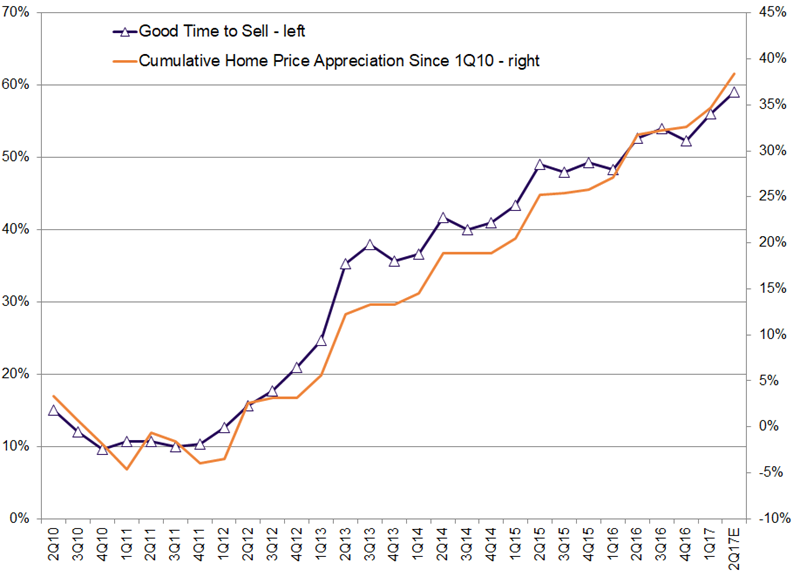

In May, 61% of respondents deemed it a “very good” or “somewhat good” time to sell, up from 57% in April and putting 2Q17 on pace to be the highest percentage since the survey began. We admit, for a casual observer, more homeowners wanting to sell their asset could be perceived as a negative sign that owning is riskier than not. But we actually believe that the opposite conclusion is appropriate.

From our perspective, a rising share of respondents considering it a good time to sell is directly correlated to home price appreciation and confidence in the housing cycle. More specifically, there is a 98% correlation between the Fannie Mae time series and cumulative national home price appreciation since 1Q10. From 1Q10 through May, our national existing home price index has climbed 38% while the share citing it as a good time to sell rose from just 15%.

While escalating home prices and affordability bear monitoring for potential entry-level homebuyers, we believe that there are two primary positive takeaways from the current situation.

First, for-sale existing and new home speculative inventory equated to just 1.5% of households in 1Q17, the lowest level of at least the last 35 years, indicating that more sellers would be easily welcomed by the market and one could argue that confidence of sellers is presently at the highest point of the recovery thus far. With embedded equity now common, sellers are ready and able, with the missing link being more new construction supply to facilitate overall growth in demand.

Second, to the extent new construction supply takes longer to come to market than demand would suggest is appropriate, the signal of confidence among homeowners would likely come through in strong home improvement spending as remodeling or expanding an existing property becomes a realistic alternative to moving.

By and large, one could nitpick the risks to the housing market such as tight labor, rising construction costs, mounting home price appreciation or limited inventory, but we believe that market forces can resolve these relatively minor issues. Alternatively, a housing recovery hinges first and foremost on a confident consumer and that is a visible tailwind today.

Friday, June 16, 2017 by Zelman & Associates

Filed under: home pricing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey