House “Flipping” Hints at Redevelopment of Stale Existing Home Inventory

Friday, June 16, 2017 by Zelman & Associates

Filed under: existing home saleshome improvementmacro housing

Last week, ATTOM Data Solutions released its quarterly Home Flipping Report, meant to quantify homes that were purchased and sold within a 12-month period in an arms-length transaction. Historically, we believe that house flipping has carried a negative connotation as it implies a cavalier, speculative approach to real estate by novice investors. This was certainly true from 2004-06 when existing home sales, single-family new construction and home price appreciation were all running at overheated paces and mortgage credit allowed for inexpensive financing costs.

However, we believe that “fix-and-flip” purchases in the current market are more heavily reliant on the “fix” component as strong demand, still-depressed new construction activity and limited existing home inventory has put a premium reward on capital that can endure the more tedious process of a large scale remodeling project.

According to ATTOM Data Solutions, almost 7% of existing homes sold in 1Q17 fit the description of a flip, stable year over year, putting 2017 on pace to at least match the 6% share from 2016, which rose from 5% in 2015.

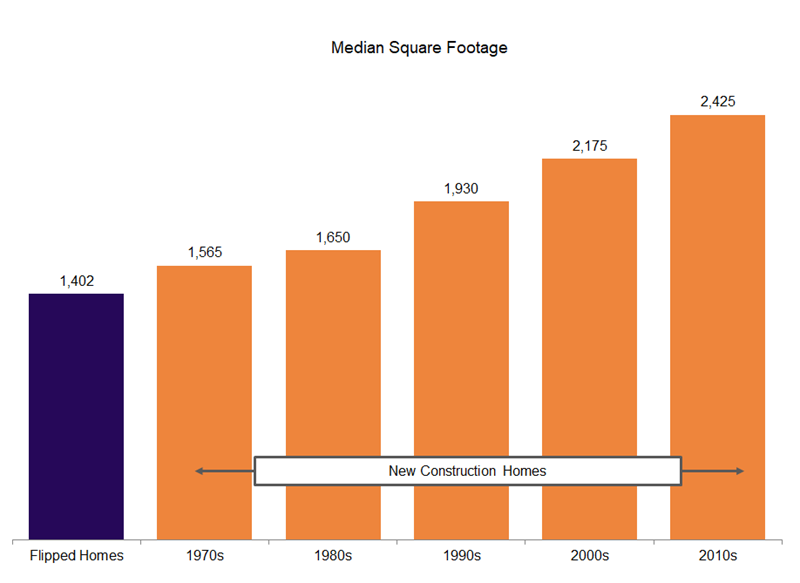

Interestingly, according to the data, the median size of homes categorized as a flip was 1,402 square feet versus 1,409 in 4Q16 and 1,428 in 1Q16. This compares to the median new single-family home built in 2016 at roughly 2,420 square feet and clearly highlights that the investments in these existing homes are occurring primarily at the entry-level price point. In fact, at roughly 1,400 square feet, we believe homes being flipped would align with 1960s inventory.

In many ways, we believe “redevelopment” would be a more appropriate term, similar to that more commonly used in other real estate areas such as multi-family buildings and retail projects. Much like those situations, a favorable return is available for investors that are able to identify areas and assets where a refurbished property has significantly more appeal to an end user.

As identified by real estate brokers participating in our monthly survey, inventory that is move-in ready – both existing homes and new construction – has considerable appeal in the current market while properties with stale finishes or poor layouts tend to linger. We view this redevelopment capital to be an important component to improving the quality of aged single-family inventory, particularly in an environment where governors around land and labor availability limit the growth opportunity of single-family new construction. Said another way, we’d welcome more headlines about house flipping.

Friday, June 16, 2017 by Zelman & Associates

Filed under: existing home saleshome improvementmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey