If a Recession is Around the Corner, You Won’t Be Able to Blame Housing

Friday, June 30, 2017 by Zelman & Associates

Filed under: macro housing

Over the last 30 years, investment in residential structures has accounted for approximately 4% of national gross domestic product (GDP). This component of GDP as defined by the Bureau of Economic Analysis covers new construction of single-family homes, multi-family projects, manufactured housing and dormitories; structural home improvements and brokers’ commissions that align mostly with existing home turnover. In essence, it is a measure of the most volatile portion of housing.

As was learned during the financial crisis, even though the direct impact of housing on GDP might appear quite small at 4%, the derivative impacts are substantial via household home equity, the banking sector’s balance sheet and consumer spending. To us, the importance of housing to the economy is immeasurable, especially today.

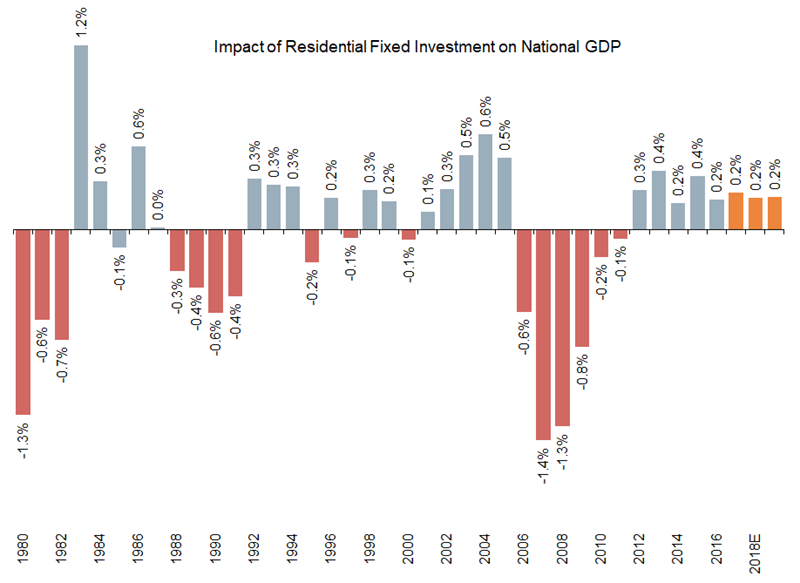

To quantify the direct effect of housing on the economy, we compare the change in residential investment versus total GDP. In years that housing is growing faster, it is an outsized tailwind to growth and vice versa. In 2016, residential investment increased 8% year over year, 3.1 times faster than the rest of the economy even with what we believe is an understatement of single-family expansion. Nevertheless, this still marks the fifth consecutive year that housing contributed excessive growth to the macro environment. Over the five-year period, residential investment increased 84% versus 18% for the rest of nominal GDP.

We believe that the current supply-demand imbalance is so severe – with the exception of urban multi-family construction – that the outsized growth contribution is likely to persist through at least 2019. A dearth of inventory on the single-family side has created favorable dynamics for new construction and home price inflation, which directly benefits about 90% of residential investment. Even in the multi-family sector, although we believe that excess supply is accumulating, the pipeline of units under construction and our anticipation of elevated future starts means investment in these projects will continue to grow rapidly.

Overall, we project residential investment to increase 10% in both 2017 and 2018, followed by 9% in 2019. This would add 20 basis points to annual GDP growth in each year, just shy of the 30 basis point average tailwind over the last five years. Recognizing that two out of the last three recessions were driven by real estate, removing that risk from the equation should significantly reduce the probability of an economic downturn over this period, in our opinion.

Friday, June 30, 2017 by Zelman & Associates

Filed under: macro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey