Single-Family Rentals Emerging from Apartment Shadows

Friday, June 30, 2017 by Zelman & Associates

Filed under: apartmentssingle-family rentalsurvey

Our proprietary survey of single-family rental owners and managers dispersed across the country suggested further fundamental improvement in May. Overall, single-family operators continued to experience strong renter demand and pricing power for their rental homes, which has been largely driven by continued improvement in employment and limited availability of single-family homes for-rent and for-sale. As a reminder, there are approximately 16 million single-family rental homes across the country, representing 19% of all single-family households and 35% of rental households.

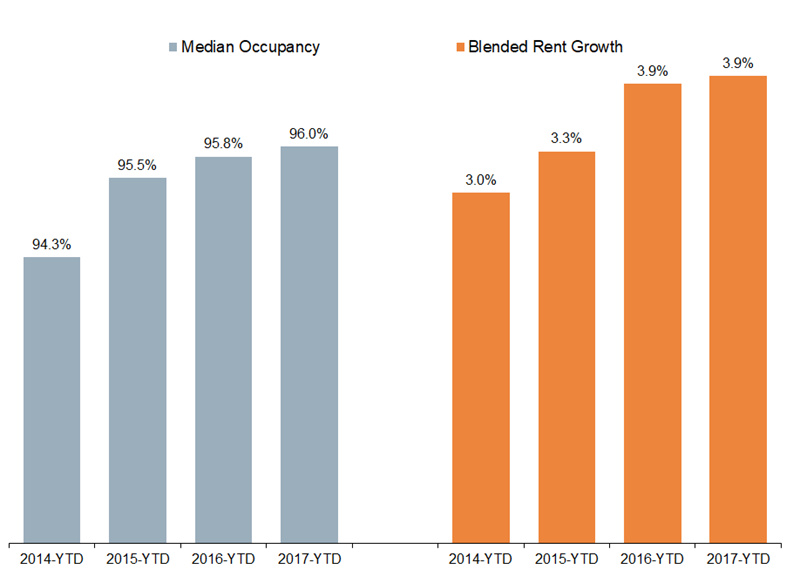

Speaking to tight conditions across the sector, median total occupancy in our survey held steady from last May at 96.0%, which was just below a cycle peak of 96.2% in the prior month. Even more telling, on a year-to-date basis, median occupancy of 96.0% was better than 95.8% in the prior-year period and 95.5% at this point in 2015. Given strengthening and above-average occupancy, pricing power for landlords also stands above historical norms. For our survey, blended rent growth remained steady at a solidly above-average level of 4.3% in May, in line with last May and leaving the year-to-date average at 3.9%, also consistent with 2016. For perspective, this implies acceleration from 3.3% in 2015 and 3.0% in 2014 for the same time period.

To the contrary, results from our comparable monthly survey of apartment operators highlight that fundamental trends in the multi-family market are struggling to maintain the momentum of the last several years. Average occupancy of 94.5% for the first five months of the year was 20 basis points lower than in 2016 while blended rent growth has averaged 2.9% thus far, down from 3.7% at this point last year and the softest start to the year since at least 2010.

We would certainly not characterize current operating trends in the multi-family market as weak, but with supply noticeably more problematic in the urban core areas while tighter supply and accelerating family formations are aiding the single-family market, we expect single-family rental metrics to remain stronger than for multi-family for at least the next two years.

Friday, June 30, 2017 by Zelman & Associates

Filed under: apartmentssingle-family rentalsurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey