Amazon Tackles Appliances – Impact to Home Depot and Lowe’s?

Friday, July 28, 2017 by Zelman & Associates

Filed under: home improvement

Last week, Amazon announced an agreement with Sears to begin selling the Kenmore brand of appliances through its website, starting with air conditioners and expanding to a full-line of home appliances at a later date.

According to public disclosures by The Home Depot (HD) and Lowe’s Companies (LOW), appliances and related products accounted for 8% and 11% of company-wide revenue, respectively, in fiscal 2016. This would rank as the third most sizeable department for each retailer, equating to approximately $7.0 billion of revenue for HD and $6.4 billion for LOW. The importance of the category to the two retailers and the fear of “the Amazon effect” among investors were visible in the stock prices dropping by 4.5% on a weighted basis on the day of the announcement – the worst daily performance versus the broader market since 2008.

It is estimated that the Kenmore brand only accounts for approximately 10% of the appliance market, having lost significant share over the last several decades alongside the demise of Sears. While taking the underperforming brand to Amazon should be a net benefit versus in Sears’ hands alone, is it enough to disrupt success at HD and LOW, either in appliances specifically or extending to other categories as well?

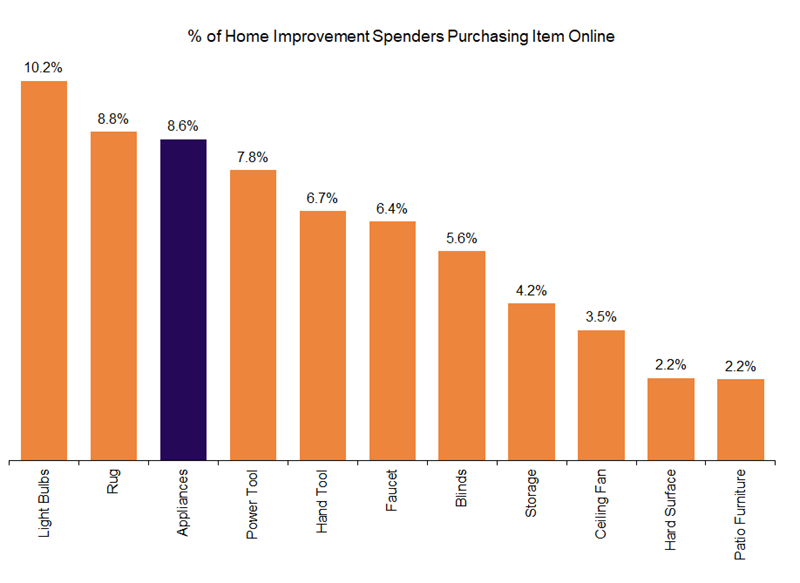

We would note that, perhaps surprisingly, the appliance category is already successfully executed online, likely after in-store comparison shopping. For instance, as part of a consumer home improvement survey we conducted in early-2016, 37% of responding homeowners reported purchasing at least one product online during the quarter to repair, remodel or maintain their home. Appliances ranked third among the surveyed categories with online penetration at 9%, trailing only light bulbs (10%) and rugs (9%) and slightly surpassing power tools (8%).

This would seem to align with a comment from Ted Decker, Executive Vice President of Merchandising at HD almost three years ago in November 2014 that “as much as we talk about interconnected retail, you'd never have thought appliances would be as strong as it is as an online category… I think that's a key learning that the interconnected, the online experience can both be educational and inspirational, but also be used for commerce on big-ticket items like flooring and appliances.”

The quote importantly highlights the acknowledgement of e-commerce as a critical tool for the entrenched retailer, even for items that might not initially appear to be at risk. With both HD and LOW investing heavily over the last decade in distribution facilities and online assets, we are encouraged that complacency is low as it relates to competing with Amazon.

We believe that the debate should instead center on brand and service. HD and LOW currently enjoy a broad selection of brands, including Bosch, Electrolux, GE, LG, Maytag, Samsung and Whirlpool with diverse delivery and installation options. Kenmore at Amazon will be largely standing alone. It is possible that one or more of these brands could eventually choose Amazon as a retailing partner, but it would certainly come at the expense of a relationship with the top two appliance retailers that control an estimated 40% of the market and offer the best of both worlds (in-person showroom and online execution).

Friday, July 28, 2017 by Zelman & Associates

Filed under: home improvement

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey