With Inflation the Topic Du Jour, Housing Will Play a Key Factor Moving Forward

Friday, July 14, 2017 by Zelman & Associates

Filed under: macro housing

In her testimony to the House Financial Services Committee earlier this week, Federal Reserve Chair Janet Yellen noted that “the [Federal Open Market Committee] will be monitoring inflation developments closely in the months ahead.” The cautionary tone relates to inflation moderating noticeably of late with some uncertainty about whether the trend will be short-lived or more structural.

Specifically, excluding the historically-volatile food and energy components that account for approximately 21% of the total index, the “core” consumer price index (CPI) was up 1.7% year over year in June, roughly 60 basis points lower than the near-term peak in August and the most moderate increase since February 2015.

There are two components of core CPI that tie directly to the cost of shelter, “rent of primary residences”, driven by the change in rents for multi-family and single-family properties, and “owners’ equivalent rent”, which is more subjective and intended to track the hypothetical rental opportunity of an owned home. These components are significant factors in core CPI, representing 10% and 31%, respectively, of the index’s weighting, and they have been outsized drivers of inflation for an extended period of time. In fact, combining the two shelter measures, inflation registered 3.4% in June, double the core CPI figure and surpassing the broader average for the 60th consecutive month. From our perspective, this has been due to strong household formation and tight housing supply putting upward pressure on rents and the overall cost of housing.

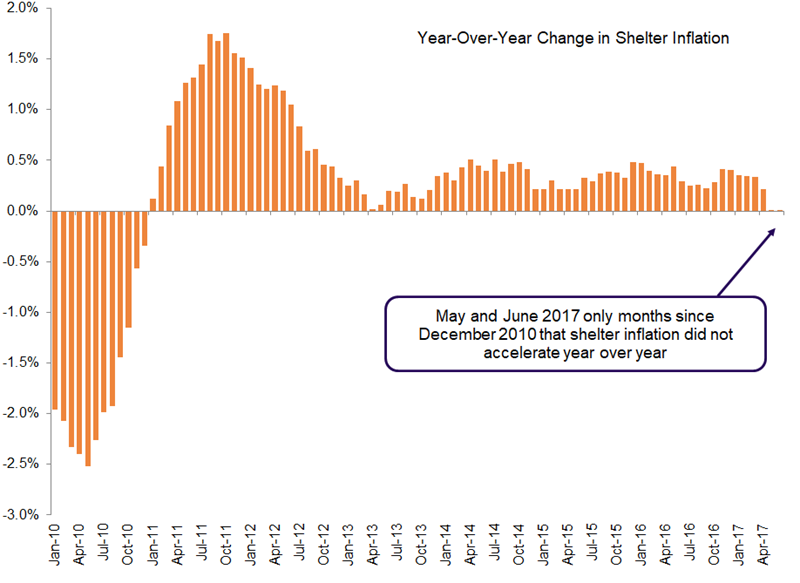

However, the new conundrum for the Federal Reserve is that while other components are dragging core CPI lower, the shelter piece has also started to decelerate. For example, while strong, the 3.4% increase in June was 30 basis points softer than in December and equal to the prior-year period. May and June are the only months that shelter inflation did not accelerate year over year since December 2010.

Our research shows that the shelter component of CPI has little correlation to home price appreciation and is more successfully explained by movements in single-family and multi-family rents. While we remain positive on the direction of single-family rents and pricing power for multi-family units in suburban locations, we expect urban multi-family rent inflation to remain under pressure due to substantial new supply. As such, we’d expect the contribution from shelter to overall CPI to persist below levels that were common over the last five years.

We would hazard to guess what happens to overall inflation, but given the significant impact of housing, we would not be surprised if overall inflation remains depressed, potentially adding to structural effects keeping long-term interest rates (and in turn mortgage rates) low.

Friday, July 14, 2017 by Zelman & Associates

Filed under: macro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey