A Sign of Discretionary Home Improvement Projects Gaining Steam

Friday, August 25, 2017 by Zelman & Associates

Filed under: home improvementsurvey

Over the last four years, our national home improvement proxy index has increased 6.0% annually, holding in a relatively tight range of 5.8-6.2%. To frame how dramatically the market has shifted from the depths of the recession, our index was down 6.3% in 2008 and 7.8% in 2009.

Relative to overall consumer expenditures, home improvement has gained share each of the last five years, overlapping the recovery of the housing market and home price appreciation. Consistent with our expectations heading into this year, first half performance across key home improvement retailers and our proprietary survey of building products suppliers indicates that outperformance is likely for a sixth straight year.

Last week, The Home Depot (HD) reported domestic same-store sales growth for its fiscal quarter ended July of 6.6%, ahead of an already strong increase of 6.0% in fiscal 1Q17. From our perspective, HD continues to execute at the top of the pack, benefiting from success across categories, with pros and do-it-yourselfers and both online and in store.

Driven by a different cadence of promotional activity in the prior period, Lowe’s Companies (LOW) posted stronger sequential improvement in domestic sales growth, with 4.6% in fiscal 2Q17 versus 2.0% in 1Q17; however, the retailer continues to trail performance of its largest peer and the broader market as it struggles to find the right balance of service, labor hours and promotions.

For perspective, on a fiscal basis, suppliers participating in our monthly survey reported growth in their home improvement business of 6.5% in fiscal 1Q17 and 5.7% in 2Q17, with the variance versus retailers’ point-of-sale attributable to timing between shipments and customer purchases as well as fluctuations in inventory adjustments by retailers.

In addition to results from the homecenters, two major co-op chains – Ace Hardware and True Value – also recently reported results for their calendar 2Q17 periods. For Ace Hardware, 2Q17 same-store sales growth of 3.2% was well ahead of negative 0.2% in 1Q17. For True Value, growth of 0.9% in the most recent quarter similarly improved from negative 1.9% in 1Q17. On a weighted basis, 2.5% growth for these retail chains in 2Q17 was 320 basis points stronger than in 1Q17.

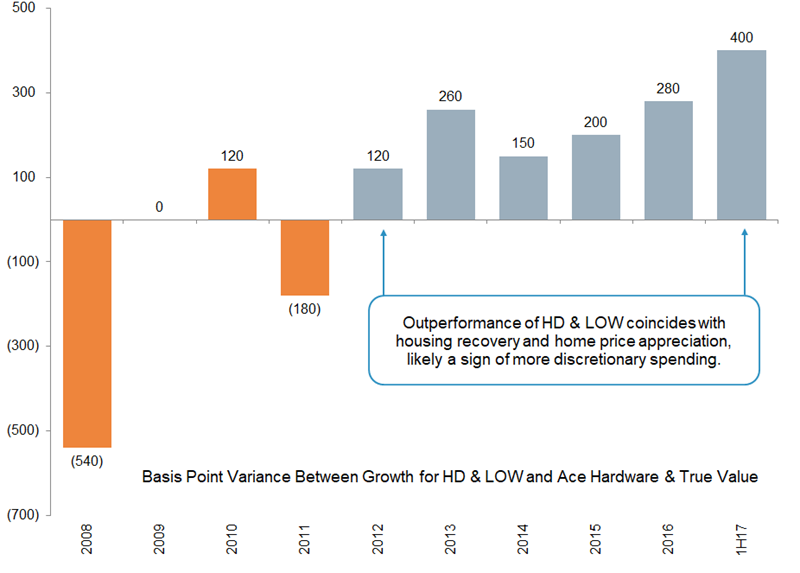

When comparing results of the homecenters with the co-ops, one has to account for slightly different fiscal calendars and weather, which has a more pronounced impact on the co-ops. Nevertheless, we find the smoothed results to be an interesting indication of the discretionary home improvement cycle given that the co-ops’ business is more skewed to smaller ticket, maintenance items. For example, in 2008, the co-ops outperformed HD and LOW by 540 basis points as a 3.1% drop in same-store sales reflected the tough economic climate but the non-discretionary tilt of the product offering helped mitigate downside relative to the homecenters.

From 2008-11, the co-op outperformance averaged 150 basis points per year. On the other hand, alongside the housing recovery, HD and LOW began to outperform in 2012, which has lasted through 1H17. Average growth for the homecenters over this period has been 235 basis points stronger than for the co-ops. We have obviously simplified non-market factors such as brand strategy, product portfolios and execution but we believe the broader argument that discretionary home improvement projects have returned is still fair.

Friday, August 25, 2017 by Zelman & Associates

Filed under: home improvementsurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey