Consumer Intentions Contradict “Bad Time to Buy” Sentiment: Which to Trust?

Friday, August 11, 2017 by Zelman & Associates

Filed under: macro housingsurvey

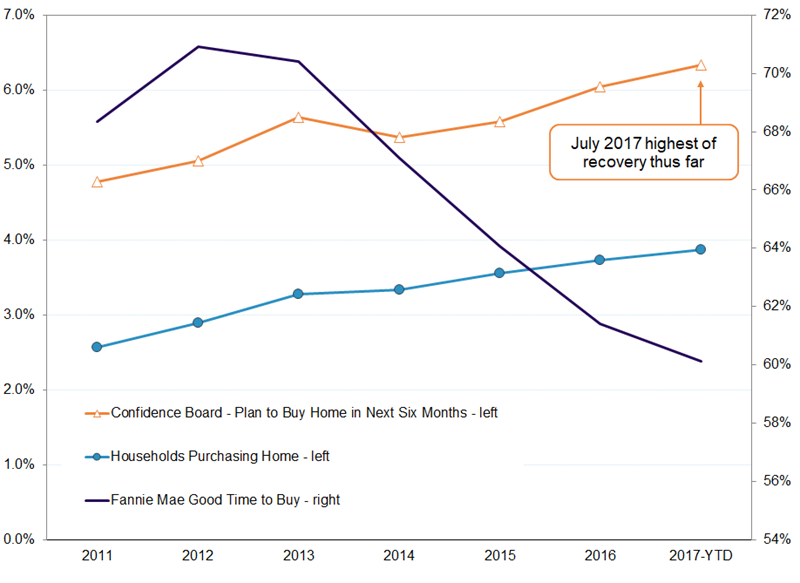

Earlier this week, Fannie Mae released the results of its monthly consumer survey focused on housing-related consumer sentiment. According to the July feedback, “the net share of Americans who say it is a good time to buy a home fell 7 percentage points to 23%, reaching a new survey low.” The net 23% share was comprised of 57% of respondents deeming it a “good time to buy” versus 34% that suggested it was a “bad time to buy”. The positive share was the first reading below 60% since the survey question began in 2010 and the percentage has been on a gradual decline since peaking in 2Q13.

This sentiment would appear to suggest that the housing cycle is losing momentum and that confidence is deteriorating. However, we believe the question is interpreted primarily from a value perspective. In other words, a “good time to buy” is when the asset is considered cheap. With national home price appreciation now in its sixth consecutive year, it is hard to argue that housing is cheap. But, that does not mean that the purchase rebound is nearing an end.

Consider the consumer confidence survey conducted by The Conference Board. In this monthly compilation, 6.7% of respondents stated that they intended to purchase a home in the next six months. Historically, the share of consumers that say they are going to purchase a home has always been higher than those that actually do, but the relative trend in the index is still informative and predictive. With that in mind, it is noteworthy that the 6.7% share in July was the highest of the recovery thus far, stepping up from 6.2% in 2Q17 and 6.0% in 3Q16.

In addition to rising optimism among consumers regarding a home purchase in the near future, the mix considering new home construction also jumped. In July, of respondents that have decided on their preference, 34% expect their purchase to be of a new home versus 66% for an existing home. The share choosing new would position 3Q17 to be the highest since 1Q10, which temporarily benefited from the timing of a homebuyer tax credit. Over the last year, the quarterly new home share has ranged from 24-25%, highlighting the material improvement of late, likely due to constrained existing home inventory.

Positively, when comparing the Fannie Mae and Confidence Board survey results against actual homebuyer behavior, we believe the outlook for transactions is bright as the latter has been substantially more predictive. In fact, the Fannie Mae “good time to buy” share has been inversely correlated to transaction activity.

Friday, August 11, 2017 by Zelman & Associates

Filed under: macro housingsurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey