Could Tight For-Sale Inventory Depress Consumer Enthusiasm Shortly?

Friday, August 25, 2017 by Zelman & Associates

Filed under: existing home salesmacro housing

Yesterday, the National Association of Realtors released its estimate for July existing home closings. Adjusted for seasonality, transactions were up 2% year over year, leaving the trailing three-month average increase at a similar 2% level. Ignoring the impact on closings from the implementation of new mortgage disclosure rules (TRID) in late 2015, the current growth in the existing home market is the weakest it has been since late-2014.

However, the share of consumers that intend to purchase a home within the next six months is rising. In July, that share stood at 6.7%, bringing the year-to-date average to 6.2% versus 5.8% at this time last year and 5.5% in 2015. So what gives? We suspect the answer of tight inventory quickly comes to mind.

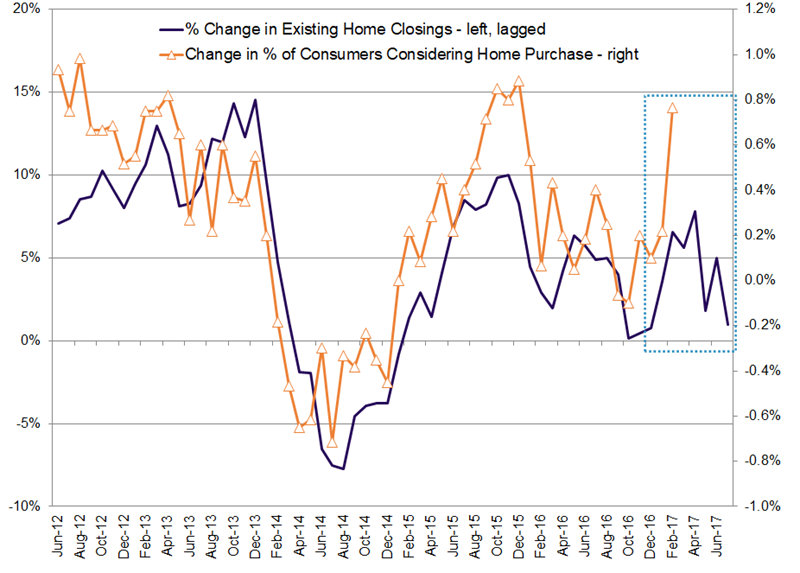

We delve deeper into the comparison of these two ratios dating back to the start of the housing recovery in early 2012. Interestingly, the strongest correlation (83%) between consumer intentions and existing home sales growth is on an eight-month lag, with existing home sales being the leading indicator. In other words, actual transactions and a healthy market give rise to consumer interest in purchasing a home. This is the exact opposite relationship than one would anticipate.

Assuming that this correlation is not spurious, it would suggest that the recent deceleration in existing home sales could put pressure on the confidence measure in the coming quarters. Is it possible that consumers will become so frustrated with limited inventory options that they reduce their confidence around purchasing a home in the near future? While we are encouraged by homebuilders ramping construction of entry-level product, which should help alleviate some of the inventory constraints and facilitate greater existing home sales velocity, it is also possible that some frustrated move-up buyers opt instead to leave the purchase market and invest in their existing home through a more expansive remodeling project.

Whether this is a good or bad outcome depends on where one sits in the housing market food chain (real estate agent, homebuilder, home remodeling contractor, mortgage originator, etc) but in the grand scheme of things, it all keeps coming back to needing more shelter to accommodate demographically-driven growth in households.

Friday, August 25, 2017 by Zelman & Associates

Filed under: existing home salesmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey