Fed Senior Loan Officer Survey Does Not Tell Entire Story on AD&C Lending

Friday, August 11, 2017 by Zelman & Associates

Filed under: apartmentsconstruction lendinghomebuilding

Last week, the Federal Reserve published its latest Senior Loan Officer Opinion Survey with the goal to “provide qualitative and limited quantitative information on credit availability and demand.” As it relates to residential real estate capital availability as compared to the range of standards from 2005 to the present, the survey concluded that “a significant percentage of domestic banks reported, on balance, that current levels of standards are tighter than the respective midpoints on loans secured by multifamily residential properties and on loans for construction and land development purposes.”

While the conclusion reads quite negatively from our perspective, we note that only 11 responses were fielded to this question, suggesting some caution is warranted before extrapolating. Additionally, we often wonder how “pure” responses are from senior members of banks to a survey conducted by one of their regulators. On top of these limitations, we believe more clarification in trends between the single-family and multi-family sectors is necessary given that we find a dramatically different willingness to lend to the asset classes by banks today.

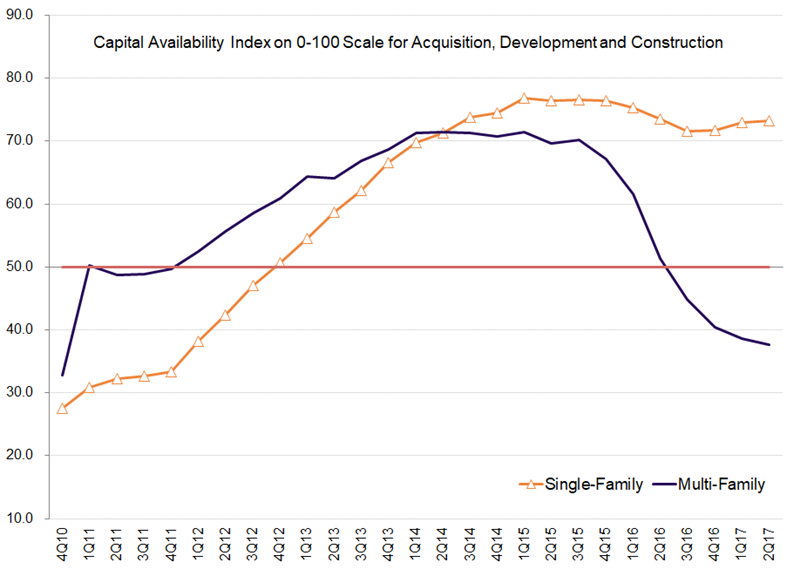

Each quarter, we conduct a survey of lenders focused on acquisition, construction and development (AD&C) loans for residential and non-residential construction. We query these executives about their perspective on industry-wide trends, with our inaugural survey conducted back in 2008. In our recently-released report, the availability of single-family credit was rated at 73.3 on a 0-100 scale, slightly improved from the prior quarter (73.0) and only marginally below the prior year (73.5). The appetite from lenders spanned relatively safe vertical construction (85.4) to riskier land acquisition and development (61.2).

Although commentary from our survey participants indicated that banks are still somewhat leery of lending for long-dated land parcels, the lack of finished lot inventory across the vast majority of markets in the country and extremely low default rates have led most to be optimistic about the outlook and the opportunity in the sector.

However, a decidedly more negative stance was conveyed in relation to multi-family projects. Overall credit availability for multi-family was rated at just 37.6, down sequentially for the seventh consecutive quarter to the lowest level since 4Q10. Strikingly, our index has dropped 32.0 points over the last two years, swinging from notable optimism to skepticism about the direction of fundamentals, even though current credit metrics remain quite strong by historical standards. For comparative perspective, over the same time frame, our single-family index moderated by just 3.2 points, or just a tenth of the change in multi-family. Juxtaposed against tight single-family supply, the pullback in bank capital for new multi-family development reflects concern about the impact from pending deliveries, particularly in urban environments.

Thus, while the Federal Reserve survey is vague about the type of construction and land development loans that are “tighter” than their historical midpoints, it is clear from our research this is only true for multi-family projects while single-family remains an opportunity for strong growth.

Friday, August 11, 2017 by Zelman & Associates

Filed under: apartmentsconstruction lendinghomebuilding

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey