While Consumer Wage Growth Disappoints, Net Income Accelerates

Friday, August 25, 2017 by Zelman & Associates

Filed under: entry-levelmacro housing

Almost a year ago in an analysis titled, “Entry-Level Wage Growth Not Great, but Continuing to Improve”, we offered a relatively optimistic outlook for entry-level incomes with the growth rate improving for two key indicators in 2016 compared to 2015 as part of a broader cyclical recovery since the recessionary troughs.

In theory, further tightening of the labor markets and downward pressure on the unemployment rate should result in more negotiating power among employees. We believe that this has in fact been occurring. For example, according to the Atlanta Federal Reserve, wage growth for employees that recently changed jobs has averaged 3.8% thus far in 2017, 90 basis points stronger than for employees in a static employment situation. That is stable with 2016 at the highest annual level since 2000.

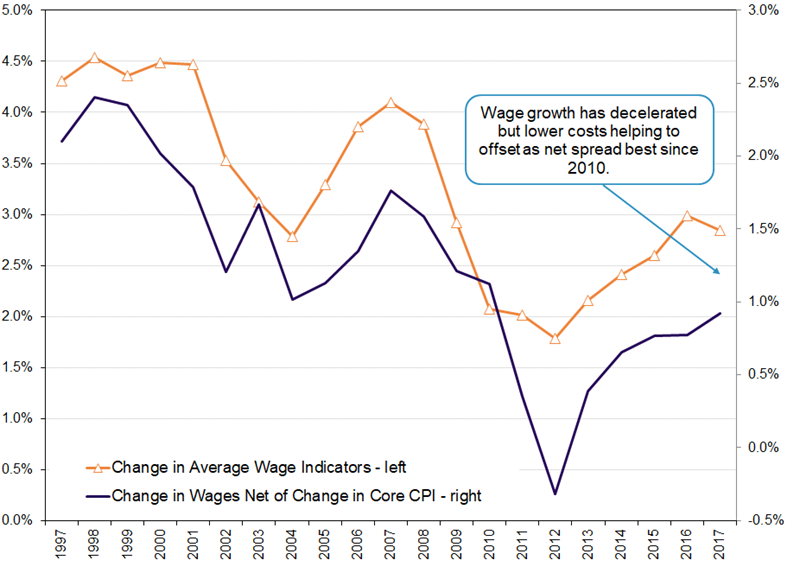

However, overall wage growth has still decelerated modestly this year. Using the same Federal Reserve analysis, median wage growth has averaged 3.3% thus far in 2017 versus 3.5% in 2016. Similarly, wage growth for non-supervisory and production employees, which earn approximately $38,000 annually and account for 82% of national payrolls, has averaged 2.4% in 2017 versus 2.5% last year. When averaging the two datasets for simplicity, this year is on pace for the first deceleration since 2012, potentially raising concern for housing affordability given continued strength in home prices and suburban rents for single-family and multi-family units.

Although some luster has come off the positive wage growth argument of late, there has been some counterbalancing on the expense side that should be considered. For example, in July, the consumer price index (CPI) exclusive of food and energy, or “core” CPI was up just 1.7%, on the bottom end of the 1.6-2.3% range that has persisted since 2013. Thus far in 2017, core CPI has averaged 1.9%, down 30 basis points from 2016.

As such, netting the change in core CPI with the aforementioned average increase in wages, we are left with a positive 90 basis point differential so far this year. While only modestly better than the prior two years at 80 basis points, it is directionally a better message than income growth alone and also represents the most favorable spread since 2010.

For the majority of consumers, stubborn wage growth that is struggling to return to historical norms is surely frustrating, but at least the byproduct of low cost inflation and depressed interest rates are consolation prizes that have helped to keep housing affordability at attractive levels versus the past.

Friday, August 25, 2017 by Zelman & Associates

Filed under: entry-levelmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey