Are Buffett, Japanese Companies the Catalysts to Unlock Innovation in Construction?

Friday, September 22, 2017 by Zelman & Associates

Filed under: homebuildingmacro housing

Earlier this month, we discussed how labor constraints have resulted in construction cycle times becoming extended to the second longest level among expansion periods dating back to 1990, trailing only 2005 when industry volumes were more than double current levels.

At our recent Housing Summit, innovation in housing was a key focal point, as it is becoming painfully clear that recent labor constraints are unlikely to ease as builders attempt to satisfy increasing demand. Builders in attendance lamented that while innovation has drastically altered the landscape of other industries, the construction process has remained largely unchanged for the last century.

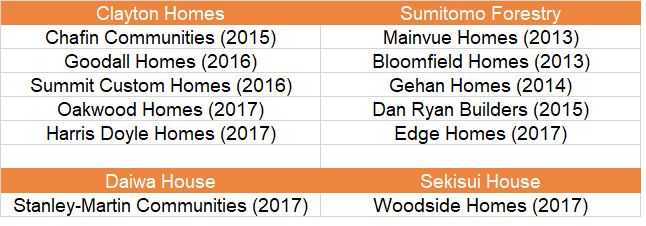

On that note, we hosted a panel of private builders that have all recently sold or partnered with strategic acquirers, including three large Japanese builders that have acquired seven private companies totaling more than 7,000 annual deliveries, as well as manufactured-housing behemoth Clayton Homes, which has been aggressively expanding its portfolio of site-built companies.

Throughout the conversation, it became clear that a perfect storm is brewing, suggesting the housing industry might finally be on the verge of the disruption and innovation that is necessary to offset structural tightness in construction labor. Notably, these strategic buyers all have deep pockets, extremely long-term capital allocation plans, a low cost of capital on par with, or even below, the largest public builders in the country, and vast experience building a large number of homes in factories.

In fact, after touring factories and R&D facilities of their new parent companies in Japan, the private builder CEOs on our panel marveled at how much more technologically advanced Japanese builders are versus their American counterparts. The shared belief was that it is only a matter of time before these companies make sizeable investments here in the United States to advance the building capabilities of their new subsidiaries.

As an example, homes built overseas by Sumitomo Forestry, Sekisui House and Daiwa House are manufactured in factories by robots and company employees, rather than on the job site by subcontractors. The production process is faster, generates significantly less waste and has superior quality control.

To be sure, many of the historical challenges to innovation still exist, including logistical issues surrounding shipping and damage and leveraging the fixed costs of production and R&D facilities during an inevitable downturn. Perhaps more importantly, it will be an uphill battle to convince municipalities and consumers on the benefits of a production-built house in a country where manufacturing housing is generally met with a stigma of “cheaper” and “lower quality”. Nevertheless, it is clear that recent strategic acquirers are playing the long game in the U.S. housing market, and we believe continued labor challenges could finally shift the odds of success for construction innovation higher.

Friday, September 22, 2017 by Zelman & Associates

Filed under: homebuildingmacro housing

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey