Given Tight Labor Market, Homebuilder Construction Cycles Extend Beyond Norms

Friday, September 8, 2017 by Zelman & Associates

Filed under: homebuildinghousing starts

As previously detailed, labor availability ranks among the biggest challenges for production builders in the current market, remarkably even with land availability, which is traditionally the most-cited hurdle for builders by a wide margin.

From 1990-2016, the median number of single-family starts per year was 1.08 million. Even with volume increasing 80% from 2011-16, the absolute level of starts still finished the year 28% below this historical baseline. While a lack of labor in a limited volume environment is counterintuitive, data on construction cycles suggest the complaints are justified.

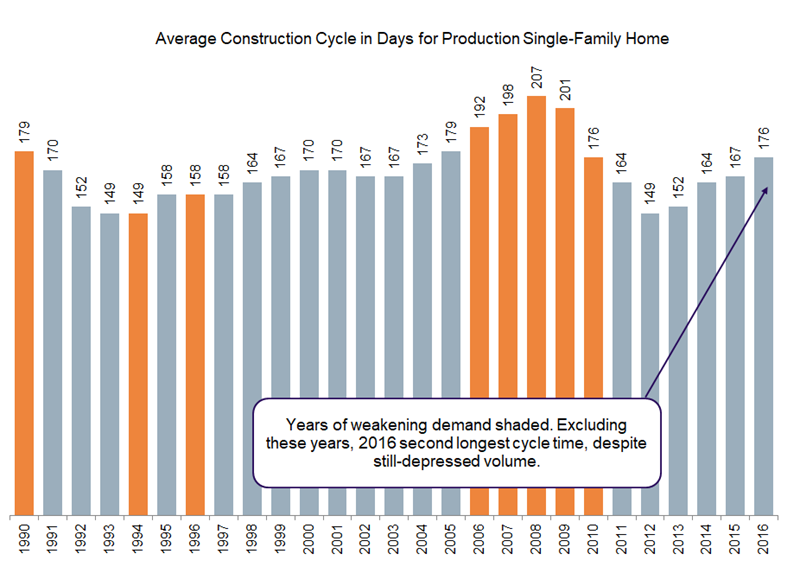

For example, production builders surveyed by the Census Bureau reported that it took approximately 176 days from start to completion for a single-family home in 2016, which compares to 167 days in 2015 and 164 days in 2014. Historically, this does not appear completely out of whack as the median construction cycle from 1990-2016 was 167 days. But when comparing on a volume-adjusted basis, we believe the stress in the system becomes more evident.

First, it is important to distinguish that construction cycles can be elongated both unintentionally due to factors like labor and weather as well as intentionally if the home was started on a speculative basis and market demand slowed thereafter. This becomes clear when recognizing that in 2008 the average construction cycle was 207 days, the longest over the history of the data set, which not coincidentally aligned with a 40%-plus decline in orders during the depths of the financial crisis.

When we exclude years when production orders were flat or negative – 1990, 1994, 1996 and 2006-10 – 2016 would rank as the second longest construction cycle, trailing only 2005 at 179 days. Most importantly, production volumes in 2016 were 54% lower than in 2005. In fact, excluding the aforementioned years when demand was weakening, the average level of production when construction cycles were close to the 2016 level was roughly 1.0 million. Thus, the collective builder universe and its labor are no more efficient today than when industry production volumes were 28% higher.

It is a striking statement that is meant without blame. Rather, it reflects the challenges of the day including: (1) more limited immigration labor that was very prevalent in the prior cycle; (2) hesitancy of younger workers to embrace the profession; (3) an aging of the workforce; and (4) the duration of the downturn that forced many to pursue another profession. As noted above, construction-related employment growth is far outpacing the national average, indicating that a solution is slowly progressing; however, this feels like a discussion that will remain at the forefront for at least the next several years.

Friday, September 8, 2017 by Zelman & Associates

Filed under: homebuildinghousing starts

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey