If Young Families Want Urban Living, is the Right Product Being Built?

Friday, September 22, 2017 by Zelman & Associates

Filed under: apartmentsdemographics

We are of the opinion that while young adults are waiting longer to get married and form families relative to prior generations, there still exists a strong pull to the suburbs and single-family homes once they reach this point of their life, led by the additional space provided and a greater focus on quality school districts.

We previously included an analysis titled “Good” Births Up Strongly For Sixth Straight Year as Family Formation Accelerates, highlighting the point that while nationwide births declined in 2016, there was a strong increase for 25-plus year old women, which we view as a catalyst for single-family demand. We advanced this argument with an analysis headlined as Second Kid Typically the Final Straw Before Heading to Suburbs.

Although we believe that underlying data support our stance, we began to wonder, what if we are missing the point and young families do want to remain in urban environments, even after the children are born? Is new product catering to this potential source of demand? As it turns out, it is not. In fact, it is increasingly designed for single tenants.

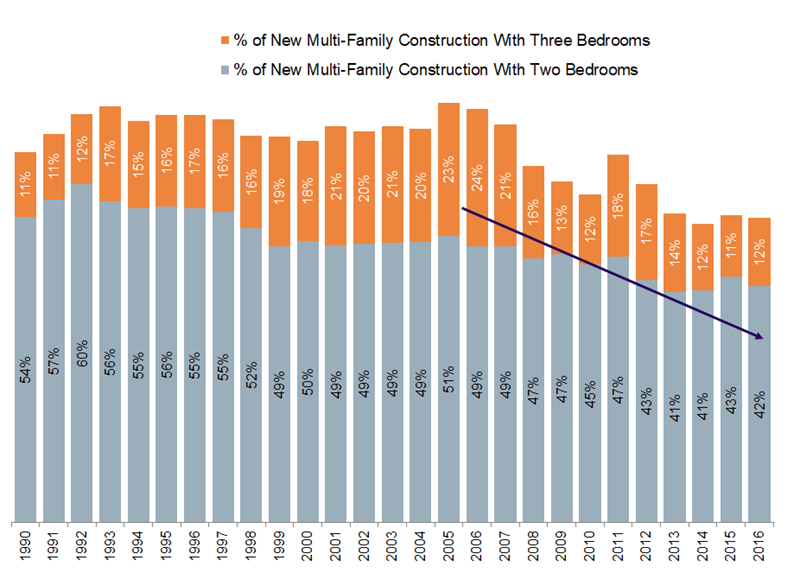

According to the Census Bureau, there were approximately 320,000 new multi-family units completed in 2016. Roughly 5% of these units were studios, marking the fifth consecutive year where the share was 4-5%. For comparison, studios accounted for only 2% of new supply in the 1990s and 2000s. Similarly, 42% of units had one bedroom in 2016, consistent with the prior three years but well ahead of 28-29% in the previous two decades. Combined, studios and one bedroom units represented 46-47% of new construction the last four years versus 30-31% in the 1990s and 2000s. This increasing share has obviously come at the expense of units with two and three bedrooms.

Framing this differently, 2002 was also a year when approximately 320,000 multi-family new construction units were delivered to the market. From 2002-16, the number of studios and one bedrooms increased a remarkable 48% while 22% fewer units with two and three bedrooms were completed. The 39% decline in units with three bedrooms is particularly striking.

As new multi-family construction in general has shifted to urban environments over the last decade, increased density has been important and square footage has been sacrificed. If there is truly an argument to be had that young adults prefer urban living to the suburban life they led as children, doesn’t it seem contradictory that incremental supply is shifting further away from this potential demand?

Friday, September 22, 2017 by Zelman & Associates

Filed under: apartmentsdemographics

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey