LIRA a Home Improvement Resource with Limitations Worth Recognizing

Friday, September 8, 2017 by Zelman & Associates

Filed under: home improvementsurvey

The Joint Center for Housing Studies of Harvard University (JCHS) is a widely-respected research center that contributes various thoughtful analyses around the housing market and demographics. In 2007, the organization introduced The Leading Indicator of Remodeling Activity (LIRA) to provide a short-term outlook for home remodeling activity. Last year, JCHS undertook a re-benchmarking exercise given volatility in the prior baseline that it determined was not representative of the underlying market and in an attempt to include repair spending.

Now, while JCHS publishes figures around home improvement spending that are less volatile, we highlight several notable limitations. First, the index is based on data in the American Housing Survey, which is conducted only every two years and released with an 18-month lag. Thus, the data must be disaggregated into annual and then quarterly components. It also means that figures since 4Q15 are based on JCHS’s regression model rather than specific fundamental data. As a result, recent published quarters are what the index says should have happened versus confirmation of actual activity. Lastly, each period published is a moving average over the prior year, making specific quarterly results unavailable.

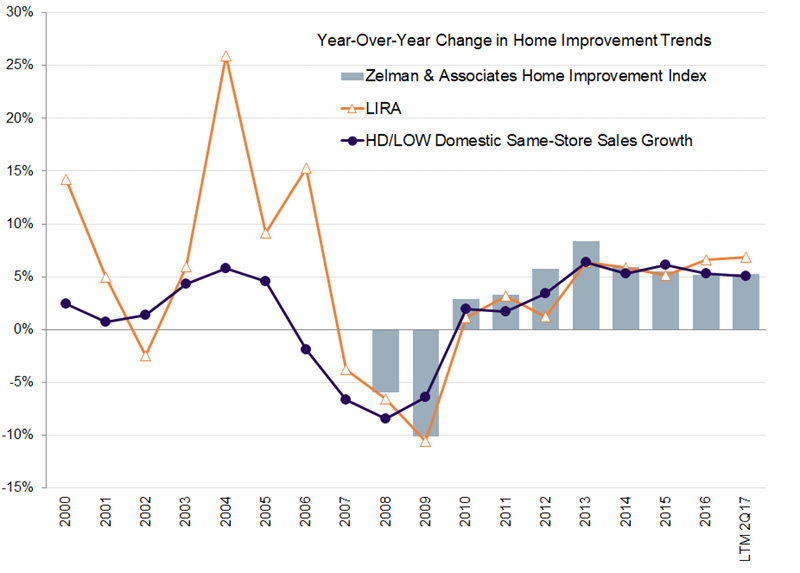

Although JCHS notes that its primary goal of the index is to be a leading indicator and identify inflection points in the cycle, based on client questions, we find that it is used as a gauge of historical activity, which we believe could be misleading. Conversely, we rely heavily on our proprietary monthly survey of building products suppliers to measure growth in home improvement spending. Our index also aligns very closely with results from The Home Depot (HD) and Lowe’s Companies (LOW), the two largest home improvement retailers in the country.

For instance, in 2016, our index increased 5.2%, HD and LOW posted combined growth of 5.3% and the LIRA increased a greater 6.6%. On a relative basis, our analysis and HD/LOW results pointed to modest deceleration from 2015, whereas the LIRA reported 150 basis points of acceleration. There is also significantly more volatility in the LIRA from 2000-06 than for the retailers.

More recently, we believe that the 6.9% growth implied by the model for the year ended 2Q17 overstates the growth in activity, with our proprietary index at 5.3% and HD and LOW reporting approximately 5.1% growth. In our opinion, public measures of home improvement activity are limited and the efforts of the JCHS are applauded as a resource for suppliers. However, we find that LIRA is being used and relied on beyond its intent.

Friday, September 8, 2017 by Zelman & Associates

Filed under: home improvementsurvey

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey