In Face of New Tech, Biggest Broker Brands in Real Estate Continue to Take Share

Friday, October 6, 2017 by Zelman & Associates

Filed under: real estate services

To many stock investors, the residential brokerage industry is viewed through the eyes of publicly-traded Realogy given its quarterly financial disclosures. With its brokerage business consistently ceding market share in recent years and the company pulling back sharply on its long-standing tradition of acquiring numerous smaller brokerages, we receive many questions whether brokerage brands more broadly are losing mindshare with agents and consumers, perhaps related to the plethora of technology platforms seeking to disrupt the industry.

To us, there are meaningful disconnects between Realogy and its foremost peers, often leading to misconceptions about the underlying business. Most notably, from 2013 through 2016, of the ten largest brokerage brands in the country, the only two to lose market share were Coldwell Banker and Century 21, the biggest and most important components of Realogy. Over this timeframe, Keller Williams posted by far the strongest share gains, while RE/MAX and HomeServices of America also improved their positions.

From an acquisition standpoint, the shift from Realogy has come about as the company has focused its investments away from gobbling up competing firms and toward the recruitment of high-producing, high-cost, individual agents. However, outside of this relatively narrow lens, traditional industry consolidation has remained meaningful in the increasingly supply-constrained resale market as firms seek avenues of growth through brokerage and ancillary operations, with two of the ten largest independent brokerage firms being acquired in the last year and a half and numerous smaller acquisitions constantly taking place.

Most recently, HomeServices of America, the company-owned real estate division of Warren Buffett’s Berkshire Hathaway and second largest independent brokerage in the country, announced the purchase of Long & Foster, the Mid-Atlantic-based firm that in 2016 ranked as the fourth largest independent based on the number of transactions. The deal immediately boosted HomeServices’ annualized transactions by roughly a third and follows the company’s expansion into New York City and acquisitions in Denver, New Jersey, Westchester and Florida over the last two years, leaving the firm roughly identical in size to Realogy’s company-owned brokerage segment.

Howard Hanna, the fourth largest independent by units, similarly made news in mid-2016 with the acquisition of RealtyUSA, which was the 9th biggest player at the time. On a relatively smaller scale in the luxury segment of the market, California-heavyweight Pacific Union recently acquired two large Southern California brokerages, effectively increasing its size by roughly 50%, while Douglas Elliman’s expansion plans have included acquisitions in Los Angeles, Southeast Florida and Boston.

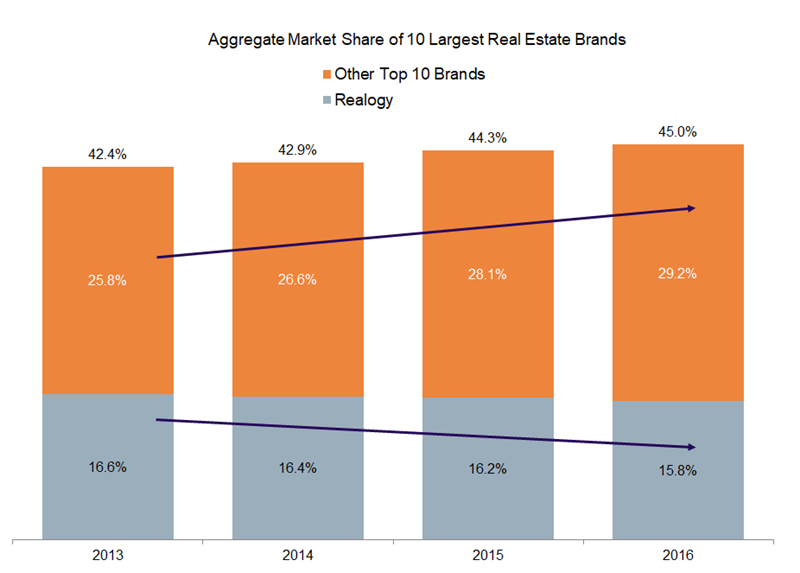

All told, despite the most publicly-followed firm reigning in its spending on acquisitions, the broader playing field has continued to consolidate and grow. By our estimates, including acquired business, the 10 largest residential real estate brands held an aggregate 45% share of transactions in 2016 that used a real estate agent, with that number expanding roughly 1% each year since 2013. This was in spite of Realogy’s share losses. Thus, annual growth over the three-year period was 2% for Realogy, 8% for the remaining top-10 brands and 4% for the rest of the brokerage industry.

In our view, despite the growth and entrance of newer technology-focused entities like Zillow, Redfin, Opendoor and Offerpad, the data suggest that long-standing national and regional brands remain in high demand.

Friday, October 6, 2017 by Zelman & Associates

Filed under: real estate services

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey