New Disclosures Show Young, Minorities and Lower Income Lead Mortgage Rebound

Friday, October 20, 2017 by Zelman & Associates

Filed under: entry-levelmortgage

Based on our national mortgage finance research, we estimate that 2.57 million unit purchase mortgages were originated in 2011, which stood 61% lower than the cycle peak of 6.60 million in 2005 and represented the lowest production since at least 1990 when our data set begins. From 2011-16, unit purchase originations have climbed 70% to approximately 4.37 million.

In 2016, we estimate that approximately 40% of unit purchase originations were securitized by Fannie Mae and Freddie Mac (the GSEs), with the remainder of units accounted for by FHA, VA and USDA government insured loans (~45-50%) and non-securitized loans held by banks and other investors (~10-15%). To help quantify the characteristics of borrowers responsible for the strong increase in production since the market trough in 2011, we utilize just-released data by the GSEs that includes more borrower information than real-time disclosures.

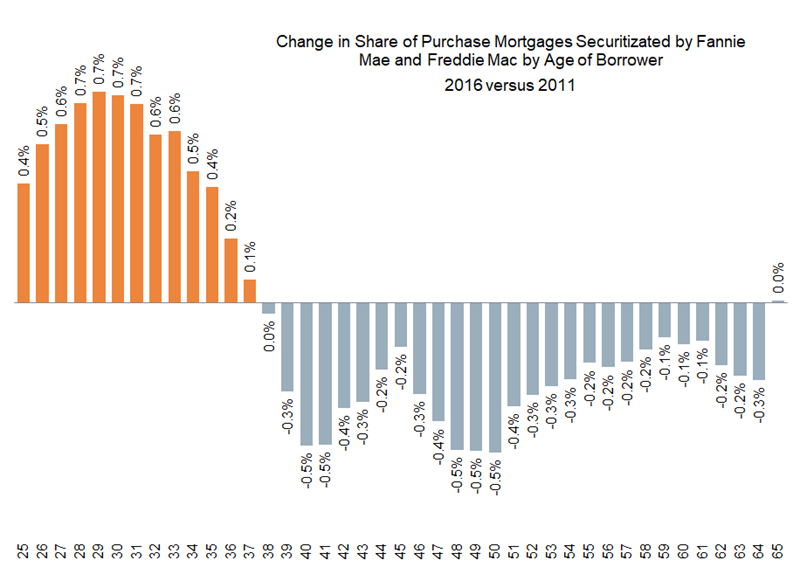

Specifically, in 2016, 36% of GSE purchase borrowers were 25-35 years old, stable with 2015 and slightly lower than in 2014. When looking at the recovery period as a whole, defined as 2012-16, the 36% share held by these younger homebuyers was notably ahead of 32% when lending was tighter from 2008-11. In fact, when comparing the share of purchases from 2011 to 2016 for every individual age cohort from 25 through 65, an increase was witnessed for each group from 25-37, while the share for all ages through 64 declined. This is not to suggest that demand from older cohorts was weak, as every five-year age group experienced demand growth from the trough. Rather, younger cohorts were simply growing faster as the recessionary effects that impacted them the most have faded.

An expansion of credit is also evident when slicing the data by race and income. In 2016, 80% of GSE unit purchase mortgage originations went to white borrowers, followed by Asian and Hispanic, both at 8%, and black at 3%. Comparing those shares to 2011, Hispanic and black homebuyers gained 270 and 90 basis points, respectively, at the expense of white and Asian borrowers, which declined 230 and 140 basis points, respectively. Similarly, borrowers earning less than the local area median income accounted for 32% of originations in 2016, up for the fourth consecutive year from the cycle bottom of 28% in 2012.

In our opinion, the increase in credit access by younger, minority and lower-income borrowers is a result of several factors, including: (1) a strong housing market, including above-average home price appreciation, and record low incremental delinquency rates making lending more attractive; (2) refinement of origination guidelines by the GSEs for items such as supplementary income, down payment requirements and debt allowance; (3) better clarity around origination requirements as the negative perception of credit availability has eased; and (4) accelerating family formation among young adults pushing them into the single-family demand environment. We are optimistic that all of these factors have room to progress further over the next several years.

Friday, October 20, 2017 by Zelman & Associates

Filed under: entry-levelmortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey