Non-Banks Dominating Origination Market with Some Startling Growth Rates

Friday, October 20, 2017 by Zelman & Associates

Filed under: mortgage

While banks dominate mortgage credit headlines given that the majority are publicly traded, host investor conference calls and are recognizable brand names, non-depository mortgage companies, and to a lesser degree credit unions, are providing substantially all of the industry’s growth.

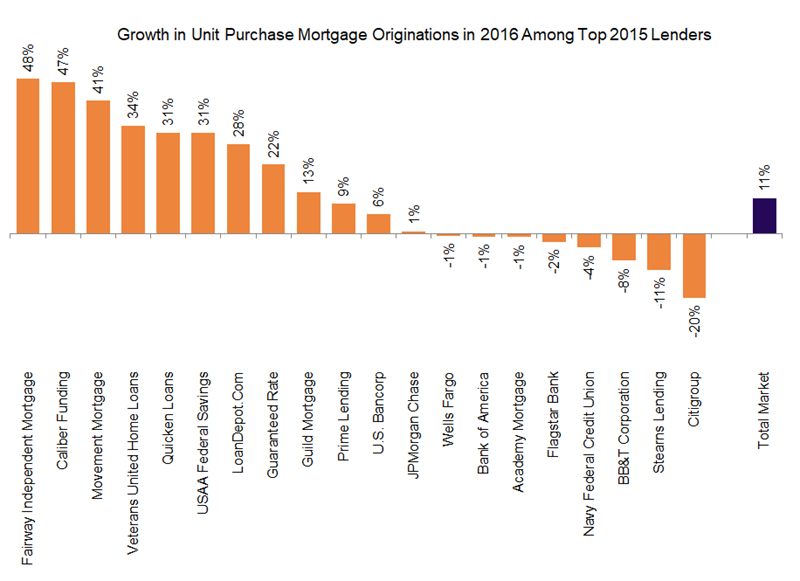

Speaking first to originations for home purchases, unit growth for banks was just 3% in 2016 versus 7% for credit unions and 18% for mortgage companies. Mortgage companies held 51% market share in 2016, the highest since at least 1990 and almost double the 1990-2006 average of 26%. Looking at the 20 largest purchase mortgage originators in 2015 by units, significant growth was posted by Fairway Independent Mortgage (48%), Caliber Funding (47%), Movement Mortgage (41%) and Veterans United Home Loans (34%). Meanwhile, declines were registered by money center behemoths Wells Fargo, Bank of America and Citigroup while JP Morgan Chase eked out just a 1% gain.

Despite the big banks also acting as the largest mortgage servicers in the country and having an edge to solicit customers for refinancings, a similar market shift story also played out on that side of the business. Unit refinance originations increased 17% year over year in 2016, including 30% for mortgage companies, 10% for credit unions and 7% for banks. When isolating the 20 largest refinance lenders in 2015, the six strongest growth rates in 2016 were posted by mortgage companies, including United Shore Financial (80%), Caliber Funding (71%), Freedom Mortgage (57%), Guaranteed Rate (46%) and LoanDepot.com (38%). In fact, SunTrust was the only bank in the 2015 top 20 that did not lose refinance market share in 2016.

We believe that the explosive growth by non-bank lenders that are also servicers raises the question of whether appropriate guidelines and capital requirements are in place. Nevertheless, from a capital availability standpoint, we view the emergence of non-bank lenders as a positive for consumers, especially given the Qualified Mortgage underwriting guardrails that have been put in place, limiting the vast majority of sins that were evident during the subprime crisis. In fact, we’d argue that the banks are largely responsible for the negative perception many qualified potential borrowers have about the availability of mortgage credit and the fading of that overhang is part of the reason that entry-level demand has consistently strengthened in recent years.

Friday, October 20, 2017 by Zelman & Associates

Filed under: mortgage

Looking for More Insightful Content?

Explore our Researchaffordabilityapartmentsbaby boomersbuild-for-rentconstruction lendingdemographicsentry-levelexisting home saleshome improvementhome pricinghomebuildinghomeownershiphousehold formationhousinghousing startsinstitutional investorsinterest ratesmacro housingManufactured Housingmillennialsmortgagemortgage ratesnew home salesreal estate servicesrefinancesg&asingle-family rentalstocksstudent debtsupplysurvey